Recently the Belgian newspaper “Het Laatste Nieuws” HLN published an article “ about how much money you need to save to maintain your life standards during your retirement.

about how much money you need to save to maintain your life standards during your retirement.

The roaring title of the article was ” 85x saving your salary- how do you do that?”. When I read an article from a journalist about personal finance, I am always very doubtful and suspicious about the underlying thinking and reasoning, the depth of the financial literacy and how it will be perceived by the general Belgian public.

Let’s reflect on this newspaper article…what did we learn and what is our perspective ?

Key Learnings Article

The journalist Frank Dereymaeker starts with a baseline statement where he compares a salary at the end of the career with the final pension of 1900 Euro. The difference between the “end of the career” salary and the pension is 1200 euro per month. So as a conclusion the journalist reasons that you need to save at least 1200 per month to bridge this money gap.

According to a study of Mercer, you need then to save at least 85 times this money gap to sustain your life standards. A total of 265.000 euro. For many Belgians this is a ton of money. So how can you achieve this result ?

The journalist compares the different ways to grow this 85x times your salary amount of money :

- Retirement saving with tax deductible government plan

- Employer (401K) Retirement Plan

- Savings Account

- Investing in the stock market

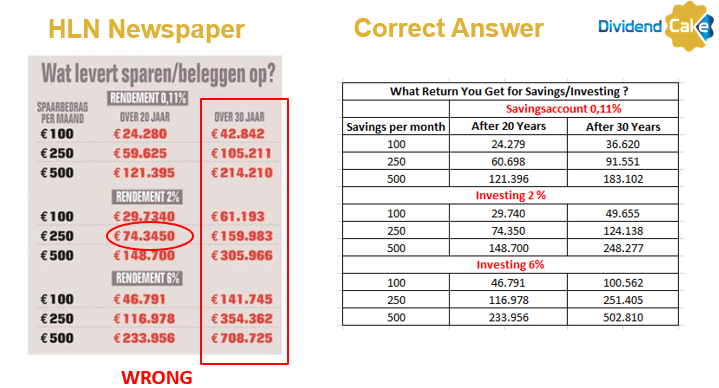

In the article the table shows the total amount of money you can achieve if you invest 100, 250 or 500 euro each month comparing a 0,11% interest rate or with a 2% or 6% return in the stock market. If you use option 1, you can achieve maximum 95.000 when you start from the age of 22. Option 2 is according to the journalist not leading to a great result either. A savings account (option 3) leads only to little capital of 21.421 euro if you save 50 euro per month. So the best option is to invest in the stock market. Invest as early as possible and diversify your investments. The S&P index had a return of 6% over the past 200 years. Someone who invested 100 euro each month had after 35 years a return of 6%. Investing in the stock market can give you the 265.000 euro that you need for your retirement.

Another option is hoping for an inheritance of your parents. As many elderly don’t know how to create a return on their money, the saved capital is mostly used to pay expenses. So what’s left is the “parents house” which is mostly sold to pay the elderly home expenses of the parents…so the capital is totally consumed.

Our Review and Opinion

When the media starts making financial recommendations and calculations, I always wonder about the financial literacy of the journalist. Soon after reading the article, I noticed several flaws in the article. The first error that I did found was the compound interest calculation table. I calculated the values myself in Microsoft Excel. What did we conclude?

All the values of the 30 year calculation are wrong. Also there’s a typo error for the 20 years 2% with a 100 and 250 euro savings per month. The values for 30 years are a lot lower than the journalist did calculate. Can he not work with Excel or calculate a compound interest table correctly? My 2 sons can do this correctly ! See our latest Financial Education class 5.

There is also a flaw in the reasoning. There’s an assumption that you need the same amount of money to pay your expenses. That is ridiculous. If you don’t adjust your spending according to your salary, you will for sure have a problem with your government pension. Never spend more than your income is important. In your retirement you should be able to withdraw 4% of your investment funds. Personally I don’t agree with that statement as it assumes you need to consume your savings when you retire. That is a bad cash flow principle.

The third error is assuming that an employer retirement plan can NOT result in 85x your salary. There are many different types of employer retirement plans. My employer retirement plan has more than a 2% return and can possibly result in more than 85x my current salary. What is the deep knowledge of the journalist to make such a simple statement ?

Investing in the stock market is definitely the best choice. I agree here and making more than 6% should NOT be difficult if you always invest in the strongest sectors and companies. The fact that the journalist can not make a decent 6% compound interest table is simply embarrassing. That is BASIC financial literacy ! In the stock market you should be able to generate minimum 8% each year.

Hoping for an inheritance is definitely not the right choice. The government and commercial elderly constitutions would like to consume all the net worth of elderly people. You need to make sure your investments can cover your future cash flow expenses.

Another important note to make is the investors’ tax (or speculation tax 2.0) forced by the political party CD&V. This imposes a 0,15% tax for all investors reaching more than 500k. So you are saving for your pension, but at the end you get taxed on your savings for your retirement. How criminal a political party and government can be ?

Final Words

The reactions of the Belgian public were again hilarious and illustrating the lack of financial literacy. The smartest reaction came from a young guy stating that the Belgian people were simply financially illiterate. The past years the CD&V politicians have imposed more and more taxes on the retail investor while at the same time asking the taxpayer money for ARCO fraud that their own Beweging.net party committed to the retail investor.

I would like to recommend to HLN journalists to do better their homework and write correct articles. This article is not helping the retail investor to invest their money in the stock market and teach them financial literacy. Why would you invest now at ALL TIME HIGHS? The media writes articles about investing in the stock market and we are in the latest phase of the bull market. Why didn’t they invest in 2009? Where was the media then? Learn how to make money in bullish and bearish markets is our advice. Put in the hard work to learn how to grow money. According to me it is also ridiculous to consume all your savings in your retirement. Learn how to generate 1200×12 months=14.400 cash flow out of the market each year and you don’t need to worry about generating and saving 265.000 Euro. Take a look at our Passive Income page. Learn how to make money and grow money ! That is more important. Read our FIRE strategy here.

My Gameplan to Financial Freedom 2.0

Leave a comment if you like what we are doing or give us feedback how you think. Thanks for following us on Twitter and Facebook and reading this blog post.

As usual we end with a final quote.

No Comment

You can post first response comment.