My Personal Portfolio

During the past 10 years, I have been interested in personal finance and the stock market in general. I attended conferences, followed courses and did a lot of reading different books. At first I was a BUY&HOLD strategy investor…buy and hold forever, right? But that didn’t seem to work out well with one big loss as a result in a German solar energy company.

My interests for intelligent investing got intrigued by reading several different books and blogs of other people building their path to financial freedom by growing their passive income. I started to buy in 2013 the first shares of a stock which gave me 18 % dividend on a yearly basis. Yes, correct …18%…do you get so much return on your money ? I still own this stock today 5 years later and have increased my position in this stock at dips of the share price.

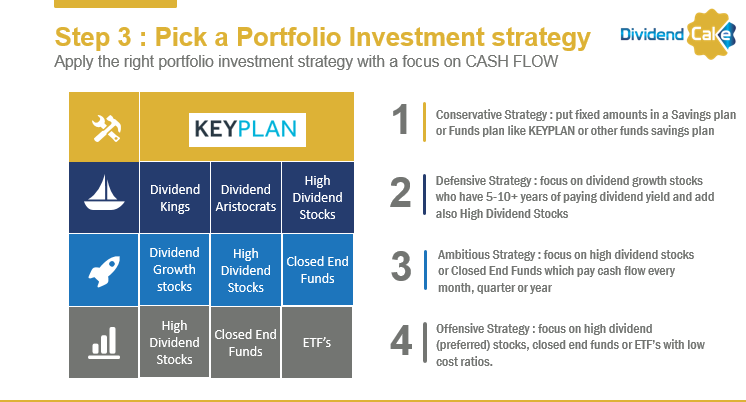

The strategy that I apply for my own portfolio is the Offensive portfolio strategy of our Financial strategy.

Infographic My Financial Strategy : Pick your Portfolio Investment strategy

The strategy aims on building up monthly and quarterly dividend payouts from stocks or Closed end Funds that payout between 8 to 20 % of dividend on a yearly basis. In Europe companies pay out dividend once a year… If you have monthly or quarterly dividend payouts, you can use this cash flow to re-invest in other dividend payout stocks, ETF’s or Closed End Funds. This accelerates the effect of the compound interest and grows your cash flow and portfolio exponentially.

In order to grow our portfolio, I have re-invested all dividends in new or additional stock purchases which grow and compound my dividend payouts on a yearly basis. This methodological approach has helped me to grow the total dividend payouts amount per year.

I illustrate with an example and my 2016 goals. At the beginning of each year I set financial goals and the goal for 2016 was to increase the monthly dividend payout amount from 100$ to 250$ by the end of 2016. Hereby I focus in the first place on monthly dividend paying stocks, CEF or ETF’s. Each year I set goals for my dividend income. Read about it in My Goals.

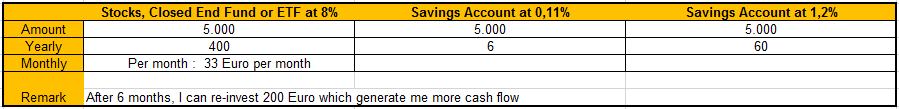

Now let’s do the comparison with a classic savings account that 90% of Belgian people use. In below table example you see an investment of 5.000 Euro. If I invest this in a classic savings account, I would get a return of 0,11% today at the major banks. Some banks offer formula’s of savings accounts which pay you 1,2% but you need to add money on those accounts on a monthly basis.

My approach is to invest this 5.000 Euro in a stock which gives me nett (after all taxes) 8% at least. This results in 400 Euro per year or 33 Euro per month. After 6 months you can re-invest 200 Euro in new shares which will pay you more dividend each month or quarter. For a classic savings account, you get 6 euro and at most 60 euro per year.

Table: How much money cash flow you get for 5.000 Euro invested in different ways?

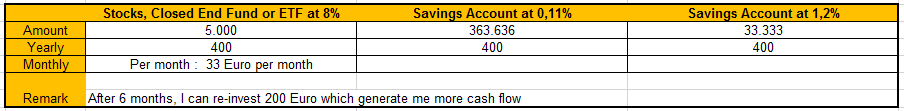

Now let’s reverse the question to YOU ! How much money would you need to put on a savings account to get 400 Euro on a yearly basis….

In order to get 400 euro on a savings account, you would need 363.636 Euro for a 0,11 % most common interest rate at the big banks today and for a 1,2 % interest rate you would need at least more than 30.000 Euro. Isn’t that crazy ? How stupid can people be doing this? In total there was end of January 2015 259,5 billion euro on Belgian savings accounts. That are official numbers of the Belgian National Bank NBB. Compared to 2014, there was an increase of 1,1 billion in savings…for such low return…crazy…isn’t it?

Table : How much money do you need to have 400 Euro cash flow per year ?

Of course, a savings account is the safest investment but at the same time, inflation is eating away your low return on cash flow. You get poorer without realizing it if inflation is higher on a yearly basis than your actual cash flow on your outstanding savings money. The fact that so many Belgian people have so much money on savings accounts is mainly for two reasons. They lack the financial knowledge about intelligent investing and the stock market as the first reason. They see it as a risky scary thing and politicians are no better…poor them. The second reason is taxes. It is the only financial instrument that has a cap where people don’t get too many taxes and can escape by using different savings accounts. Politicians have a blind eye for that one (scared to be not re-elected) and banks (ab)use this people’s behavior too and steer people in more risky own bank products such as managed funds with high entry and management fees on a yearly basis.

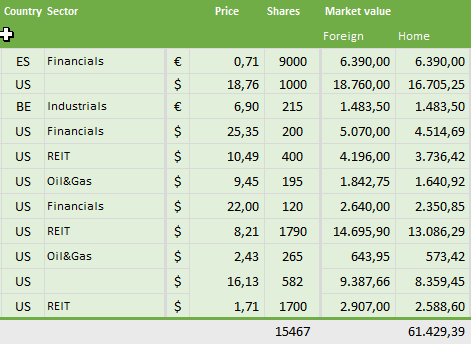

My portfolio consists mainly of US stocks or Closed End Funds today. You can see the composition today in the overview below. It is composed of monthly, quarterly and yearly paying stocks or CEF’s. If you want to know the total dividend cash flow per year, follow the Dividend Report Out blogposts on this blog.

My own Portfolio (as of End Sept. 2016)

Please note that the value of my portfolio can go down and up but who cares? As long as they pay me good money..

Intelligent Dividend Cash Flow investing is a methodological approach to investing within the stock market. Therefor I advise you to review the price, risk and cash flow of each investment that you make.

Also for me, this is a journey to grow my cash flow and passive income. Everyone makes mistakes but I believe I am on the right track. Keep on the right focus and apply the same approach over and over again. The only thing that gives me pleasure is to see my dividend cash flow come in each month.

If you want to learn more, continue to follow this blog and give a donation to my foster child in Nepal.

I appreciate and thank you in advance for your contribution.