July has passed and one sports event jumped out on the sports headlines for me. The eight victory of Roger Federer in the tennis Wimbledon final. It was a memorable milestone for Roger Federer, who became the first man in the history of the Wimbledon Championships to lift the title eight times.

Well…this dividend income report will show the eight time that I will lift my dividend income to a new record. Yes, correctly ! When I reviewed my results, I noticed that this dividend income for July 2017 is the eight record lifting it to a NEW ALL TIME HIGH record. More about it below…

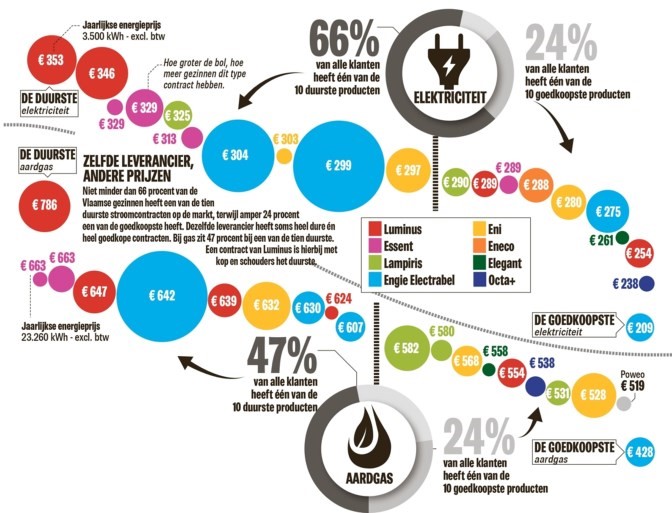

In July we continued to learn options investing and we enjoyed our vacation in France until the first week of August. On the 1st of July I also changed electricity supplier. I now pay approximately 20 euro less per month. But a study revealed that around 66% of Flemish families still pay 672 euro too much for their electricty and 47% for their gas. It is sometimes even possible to have a cheaper contract with your current supplier. Well, I joined a group purchase and compared with my current supplier prices. The decision was quickly made…

This 20 euro is almost the same amount as the amount I put in a Keyplan for my foster child Anisha in Nepal. A nice quick win. Reviewing your expenses on a yearly basis gives you more money to invest and pay yourself first. I also read in an article that the stupid Belgians are stubborn and keep on increasing money on their savings accounts. Investors who want more return, are mostly advised by their bank advisor towards high cost managed funds. This explains the increase in funds purchases to an amount of 3,8 billion in July reported by the financial newspaper De Tijd.

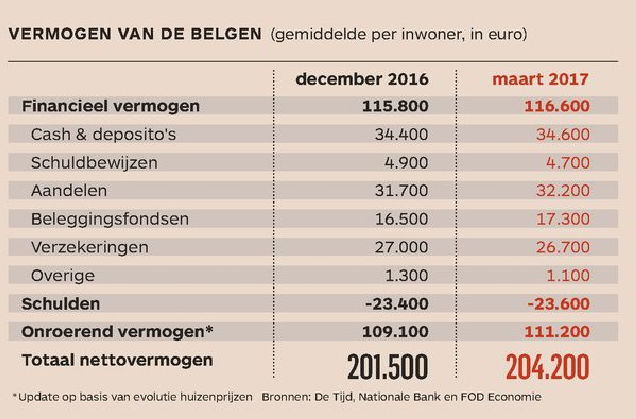

The same newspaper De Tijd gave a comparison of the average net worth of a Belgian. This average net worth increased from 201.500 euro to 204.200 euro. Belgians got 8 billion richer thanks to increasing stock markets and capital gains on their investments. But this is only a small percentage of the Belgian population as only around 15% of the families invests in the stock market…sad isn’t it?

On 27th of July we celebrated finally TAX LIBERATION DAY and we are no longer working for the government. We finally earn money for ourselves….Should we be happy about this? When I tell this to foreign colleagues, they aways look at me with disbelief….I also find it horrific. When will we have a government that will spend less than she earns and taxes less from her citizens. The government debt keeps on increasing…

I would love to move to a country such as Malta, Cyprus or any other country where the tax deliberation day falls in March or April. It is not surprising that wealthy Belgians already move to countries such as Malta, Portugal, Switzerland and others where the government can be trusted…

When wealthy people relocate..there are less people to pay taxes. Now a study of Securex was published saying that the Belgian employee does not want to work until the age of 67. The government increased the pension age from 65 to 67. The majority who are motivated would like to retire at the age of 60, the others that work out of a necessity, would like to retire at 56. The government wants to FORCE the Belgian working class to work longer…but forcing someone also leads to resistance. In the meantime we see large companies such as Proximus, ING, and others lay off aging employees because they become too expensive. The study says the government needs to change their message. The question should be “How can we motivate people to work longer according to their talent and competences? ” instead of the current message of “how can we force companies to retain older employees and force employees to work longer?” Maybe the government should support companies with retraining older employees towards new competences and lowering the cost of labour for older employees. With a large group of baby boomers retiring soon and a decreasing working population paying more and more taxes, the challenges are huge in a country such as Belgium.

Last but not least I conclude with a must-read article from Business Insider. A financial planner explains the hierarchy of personal financial priorities. Nr 1 is Enjoy life while living below your means, Nr 2 is Financial Protection (Read our article about “How to size correctly your Emergency Fund“) and third “Investing to achieve financial independence”. Follow this wise advice I would say.

So let’s go towards our Market Analysis.

Market Analysis

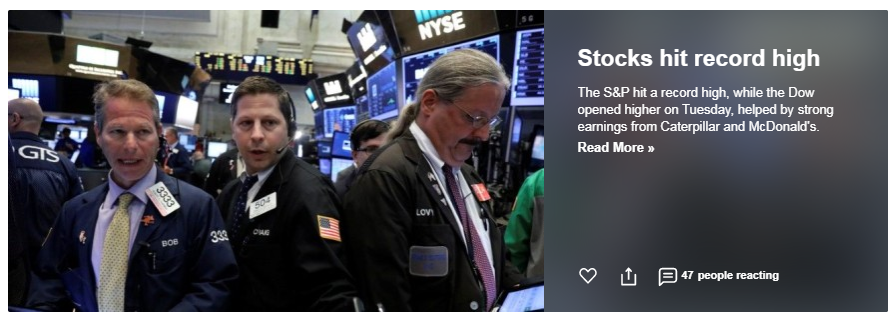

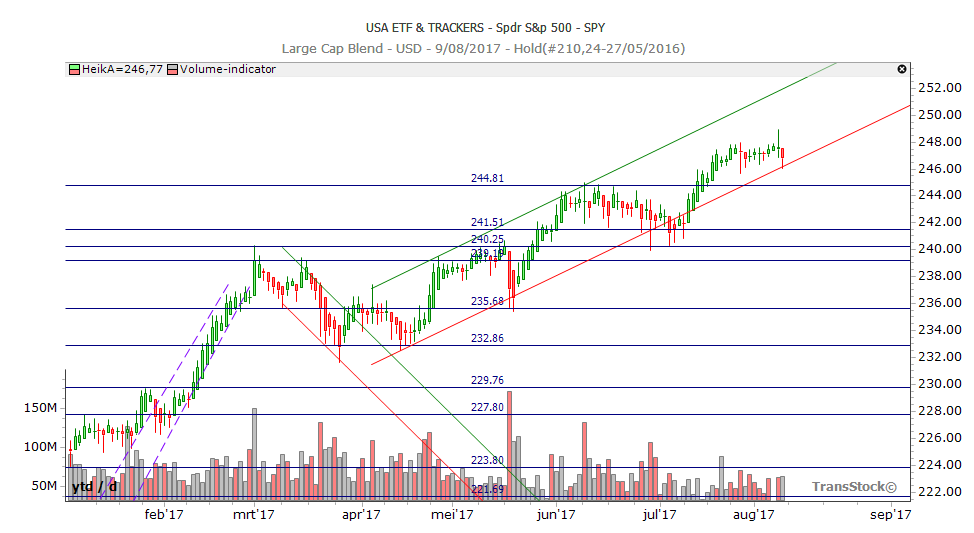

When we analyse the performance of the SPY (screenshot 10 August) we can conclude that after the consolidation phase between 241 and 245 we pushed in July and early August higher to 247 level and a new all time high early August. Will we remain in this trend channel higher or is it time for a market correction ? Jim Rogers warns for the highest crisis ever. Every week there’s an analyst predicting a market correction before the year end…

But even as tensions heightened between the U.S. and North Korea and violence broke out on the streets of Charlottesville, Va., stocks took the alarming news in stride, continuing to scale the “wall of worry” in defiance of doomsday predictions of an imminent selloff.

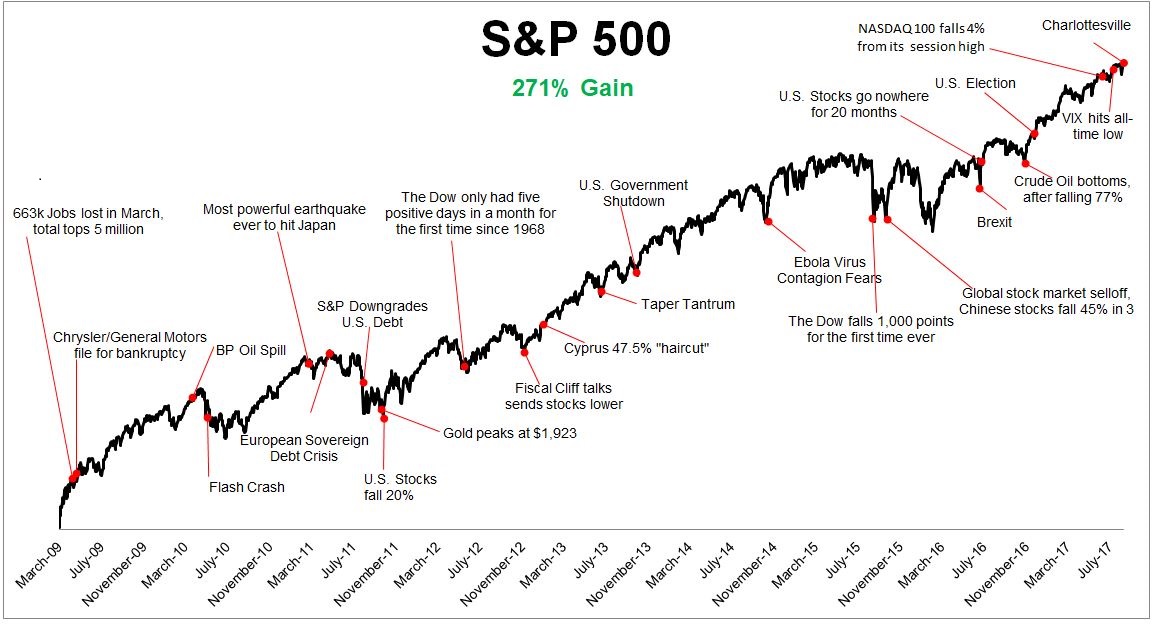

“It seems like every day the headlines outside of the market get more and more frightening,” said Michael Batnick, director of research at Ritholtz Wealth Management, who illustrated the resilience of the market in the chart below. As the graph shows, since stocks bottomed in March 2009, the S&P 500 index SPX, -0.18% has soared 271% to multiple records, meandering higher through the European debt crisis, Brexit, and the U.S. presidential election. “This year has been the perfect reminder that political volatility does not necessarily translate into the stock market, with this being the quietest year since 1965,” he said. Much of the market’s stoicism can be attributed to strong fundamentals as the economy continues its steady pace of expansion along with robust corporate earnings. Optimism over President Donald Trump’s pro-business agenda, including promises of lower taxes and deregulation, has also helped to keep the market’s upward trajectory intact. Some of that euphoria has waned since the early days of Trump presidency amid a series of political setbacks such as the high-profile failure to repeal and replace Obamacare. But investors, to a large degree, still seem to have faith that the embattled president will deliver the tax reforms he had pledged.

Batnick, meanwhile, believes psychology deserves more credit for keeping stocks buoyant. “Rising prices attract buyers and falling prices attract sellers,” he said. Likewise, the analyst believes that when the end comes, it won’t be triggered by the usual suspects like elevated valuations. “This is sort of a chicken and egg problem,” said Batnick, in response to a question on what will derail this market. “It won’t be a high cyclically adjusted price-to-earnings ratio or news coming out of Washington, the answer to that question is simply falling stock prices.”

I fully agree with the analysis of Batnick and this time there won’t be an event derailing the stock market. Stock prices just have to fall back to the correct price value before they can go higher again. Source www.marketwatch.com

Let’s dive in the numbers of my July 2017 Dividend Income Report.

Dividends received in July 2017

In the month of July 2017 we received the NEW RECORD TOTAL of 2198,59$. Another solid month above 300$, our 2017 yearly objective. Simply amazing !!

![]()

Now let’s analyze the breakout.

We received 737,89 dollar from our monthly paying stocks and ETF’s. We received 1460,70 dollar from our quarterly dividend paying stocks and ETFs. See our detail overview of all our dividend payouts. We broke our monthly and quarterly record. Amazing …

![]()

Portfolio Analysis and Growth

Compared to June 2017 we added two new quarterly paying positions and added to one monthly paying Closed End Fund. The two quarterly paying yielders paid me 304,83 $. Other quarterly paying ETFs also paid me more. As I added to one monthly paying CEF, they also paid me 50$ more. Compared to June 2016 we have a solid growth and basically doubled our monthly payout.

We realize that more than 2000$ is incredible and that is more than some salaries in Belgium. I always receive emails from a newspaper which highlights per week the salary of a Belgian employee. The past three weeks there was a cleaning lady, a bus driver and a young engineer. The salaries ranged between 1200 to 1600 euro netto. Actually my dividend income for July 2017 was higher than this range. This is the first time I feel like I received a second salary….

The Euro/Dollar trend

We keep on following the EURO/USD valuation. The EURO rallied to 1,18 at a certain moment in August. We did not convert a piece of our EURO cash position in Dollars. We keep on following this chart closely. We don’t worry about this as we are an investor for the long term but we see the value of our portfolio decrease. Some positions show in the red due to the currency rate in my euro broker platform. As a dividend investor, you should only worry about red if the dividends are not sustainable.

In July this title “Increase in Euro value will not continue” appeared above an article in the newspaper De Tijd.

Koen De Leus thinks that by the end of the year the euro will have dropped towards 1,07 dollar. It’s always interesting to follow an analyst prediction…we will see. A value of 1,07 Euro versus dollar would increase the value of my portfolio with almost 15%.

Going forward

How are we doing on our journey towards our 2017 Objective?

We did a SMART objective of 6600$ for 2017 and we have now achieved this yearly objective. We now have received a total of 7432,01 dollar.

![]()

We have also been reflecting on whether we should say that we have achieved our yearly goal…a lot of things can happen. A black swan event can always occur which could blow away all my dividend income. I say this for the following reason. I remember the sell off of the company PSEC in May 2017 where I sold all my shares around 8,5$ and secured my 2k capital gains. Last friday the stock dropped to a low of 7,12$ after announcing a dividend cut of 20%. This share price would have put me in the red and losing money….

So going forward we will no longer conclude that we achieved a financial goal until we review our yearly objectives in January 2018.

What do you think about our monthly performance ? How was your passive income growth ? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! As usual we end with a quote. Never forget this one !

7 Response Comments

Great article of business insider! simple and logic advice.

Very profound and interesting analysis! Congratulations on your new time high, very motivational for us!

THANKS Melon Deal.

This is an amazing result. Doubling $10 to $20 is not a big deal, but going from 900 to over 2k is really fantastic!

I’m still keeping my PSEC shares. A dividend cut is never nice, but sometimes necessary. It still provides a nice yield; let’s see how they will perform during the next year…

Thx. I might pickup PSEC again at a price of 6 or lower. We will keep an eye on our watch list.

Amazing results and truely inspiring. Thanks for sharing your report!

Thank YOU !