Vacation is starting tomorrow on the 1st of July and people have now more time to relax, read and enjoy some quality time with family and/or friends. At the end of June, I noticed an interesting article of Fredrik Arnold on Seekingalpha.com.

Fredrik Arnold gives an insight on Warren Buffett’s Portfolio. If you see the chart of Berkshire Hathaway, you realize that people who invested in April 2010, have now tripled their money… nice performance, isn’t it?

Fredrik Arnold gives an insight on Warren Buffett’s Portfolio. If you see the chart of Berkshire Hathaway, you realize that people who invested in April 2010, have now tripled their money… nice performance, isn’t it?

1. Warren Buffett’s Portfolio

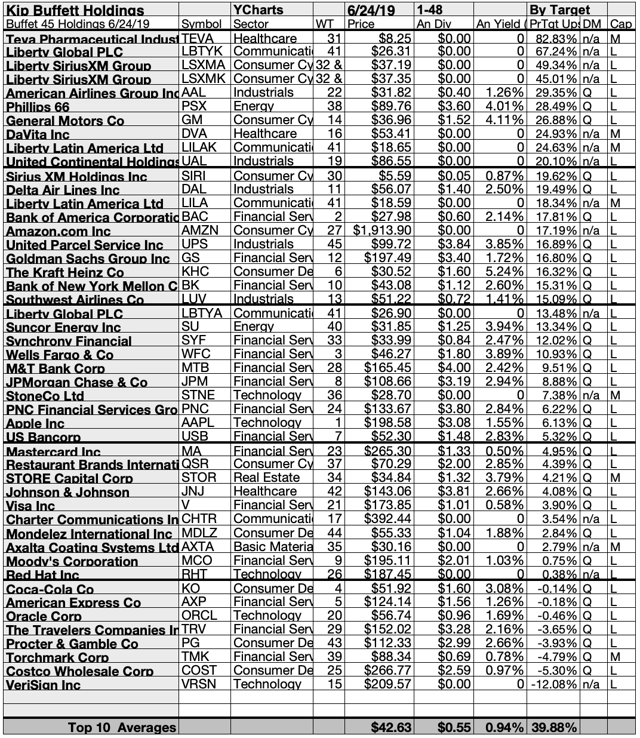

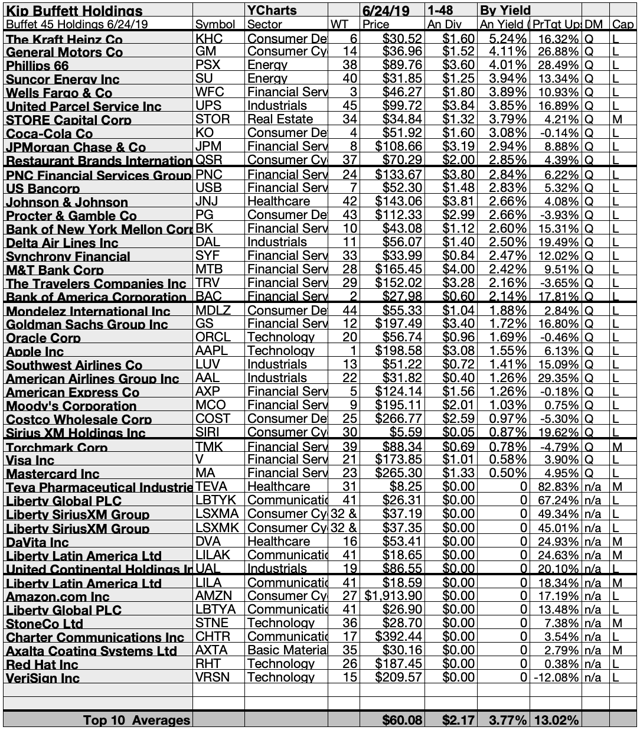

33 of 48 Berkshire Hathaway selected stocks paid dividends. As of 24th of June, the top ten ranged 2.85%-5.24% by annual yield and ranged 20.10%-82.83% per broker-estimated price-target upsides. Ten top Buffett-held dividend stocks ranged from 16.97% to 31.5% in net gains.

James Brumley said in Kiplinger Investing:

“Rich people often get perpetually richer for a reason, so it could be worthwhile to study what billionaires and high-asset hedge funds are plowing their long-term capital into.”

As any collection of stocks is more clearly understood when subjected to yield-based analysis, this Buffett-holdings list is perfect for the dogcatcher process. Here is the June 24 data for 33 dividend paying stocks in the Kiplinger-documented collection of 48 owned by his Berkshire Hathaway (NYSE:BRK.B) firm. The chart above is from BRK.B.

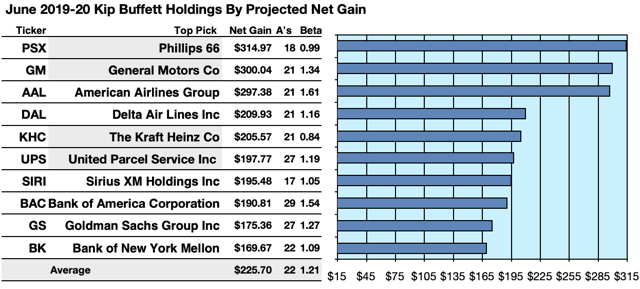

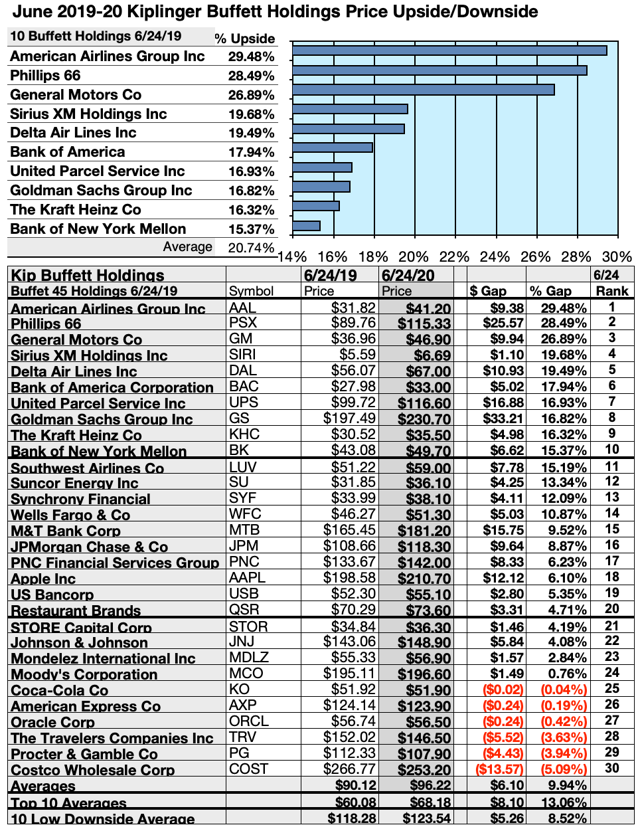

Actionable Conclusion : Analysts Estimated 16.97% To 31.5% Net Gains For Ten Top Buffett-Held Dividend Stocks Come June 2020

Four of ten top yield Buffett-held dividend stocks by yield were among the top ten gainers for the coming year based on analyst 1-year target prices. (They are tinted gray in the chart below). Thus, this yield-based forecast for these Buffett dogs was graded by Wall St. Wizards as 40% accurate.

Source: YCharts.com

Projections were based on estimated dividends from $1,000 invested in each of the highest yielding stocks and their aggregate one-year analyst median target prices, as reported by YCharts. Note: one-year target prices by lone analysts were not applied. Ten probable profit-generating trades projected to June 24, 2020, were:

Phillips 66 (PSX) was projected to net $314.97, based on a median of target price estimate from eighteen analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risks 1% less than the market as a whole.

General Motors Co. (GM) was projected to net $300.04, based on the median of target estimates from 21 analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risks 61% more than the market as a whole.

American Airlines Group (AAL) netted $297.38 based on a median of estimates from twenty-one analysts, plus dividends. The Beta number showed this estimate subject to volatility 61% more than the market as a whole.

Delta Air Lines Inc. (DAL) was projected to net $209.93, based on dividends, plus the median of target price estimates from twenty-one analysts, less broker fees. The Beta number showed this estimate subject to volatility 16% more than the market as a whole.

The Kraft Heinz Co. (KHC) was projected to net $205.57, based on a median of target price estimates from twenty-one analysts plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk 16% less than the market as a whole.

United Parcel Service Inc. (STAY) was projected to net $197.77, based on dividends, plus a mean target price estimate from twenty-seven analysts, less broker fees. The Beta number showed this estimate subject to risk 19% over the market as a whole.

Sirius XM Holdings Inc. (SIRI) was projected to net $195.48, based on dividends, plus the median of target price estimates from seventeen analysts, less broker fees. The Beta number showed this estimate subject to risk 5% more than the market as a whole.

Bank of America Corporation (BAC) was projected to net $190.81, based on the median of target price estimates from twenty-nine analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risks 54% more than the market as a whole.

Goldman Sachs Group Inc. (GS) was projected to net $175.36, based on dividends, plus the median of target price estimates from twenty-seven analysts, less broker fees. The Beta number showed this estimate subject to volatility 27% more than the market as a whole.

Bank of New York Mellon (BK) was projected to net $169.67 based on dividends, plus the median of target estimates from twenty-two brokers, less transaction fees. The Beta number showed this estimate subject to risk 9% more than the market as a whole.

The average net gain in dividend and price was estimated at 22.57% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risks 21% more than the market as a whole.

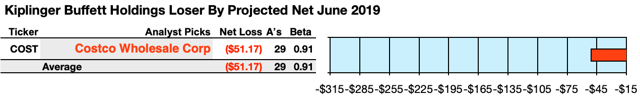

Actionable Conclusion : (Bear Alert) Analysts Predicted One Buffett Top Yield Dog To Show A 5.17% Loss to June 2020

The probable losing trade revealed by YCharts to 2020 was:

Source: YCharts.com

Costco Wholesale Corp. (COST) projected a loss of $51.17 based on dividend and a median of the target price estimates from twenty-nine analysts, including broker fees. The Beta number showed this estimate subject to risks 9% less than the market as a whole.

Source: businessinsider.com.au

The Dividend Dogs Rule applied by Fredrik Arnold

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”.

48 Buffett Picks By Target Gains

48 Buffett Picks By Yield

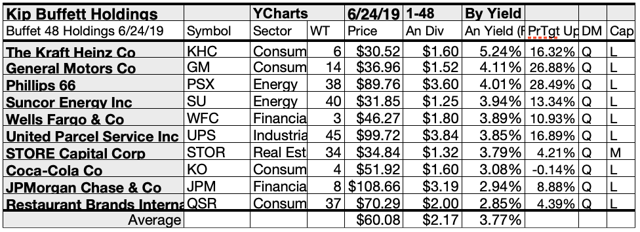

Actionable Conclusion : 10 Top Buffett-HeldStocks By Yield

Top ten Buffett-held stocks selected 6/24/19 by yield represented six of eleven Morningstar sectors. Top dog from the consumer defensive sector placed first, The Kraft Heinz Co. (KHC) [1]. Another consumer defensive holding placed eighth, Coca-Cola Co. (KO) [8].

In second place was the first of two from the consumer cyclical sector, General Motors Co. (GM) [2]. The other placed tenth, Restaurant Brands International Inc. (QSR) [10].

Two from the energy sector placed third and fourth, Phillips 66 (PSX) [3], and Suncor Energy Inc. (SU) [4].

Fifth and ninth places were claimed by financial services, Wells Fargo & Co. (WFC) [5], and JPMorgan Chase & Co. (JPM) [9].

The lone industrials representative placed sixth, United Parcel Service Inc. (UPS) [6].

Finally, the seventh slot was claimed by the lone real estate sector representative in the top ten, STORE Capital Corp. (STOR) [7], to complete the June Buffett-held top ten dividend dogs, by yield.

Actionable Conclusions: Top Ten June Buffett-Held Dividend Dogs Showed 15.37%-29.48% Upsides While (31) Six Lowly Downsiders Ranged -0.04% To -5.09%.

Source: YCharts.com

To quantify top dog rankings, analyst mean price target estimates provide a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analyst mean price target estimates became another tool to dig out bargains.

Analysts Forecast A 10.58% Advantage For 5 Highest Yield, Lowest Priced Buffett-Collected Dividend Stocks To 2020

Ten top Buffett-held dividend dogs were culled by yield for this update. Yield (dividend/price) results provided by YCharts did the ranking.

Source: YCharts.com

As noted above, top ten Kiplinger Buffet-chosen dividend dogs showing the highest dividend yields, represented six of eleven Morningstar sectors.

Stocks listed above were suggested only as possible reference points for your Kiplinger Billionaire Picks stock purchase or sale research process. These were not recommendations.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from IndexArb; YCharts; Yahoo Finance; analyst mean target price by YCharts. Dog photo: businessinsider.com.au

2. What can we learn from Warren Buffett’s portfolio

There is three simple basic investors rules we can learn from this portfolio

Rule 1 : Let’s keep it SIMPLE

Investing should never be considered a ‘get rich quick’ scheme. You need to remain invested for at least five years, but preferably much longer to give your investments the best chance of providing the returns you’re hoping for. Even then you must be comfortable accepting the risk that you could get less than you put in. If your investment goals are short-term, for example, two or three years away, investing won’t be right for you, as you’ll need to keep your money readily accessible, usually in a savings account. Before you put your money into any investment, take time to research it thoroughly, so you understand exactly what’s involved and what the risks are. Funds, for example, issue a Key Investor Information Document (KIID), or Key Information Document (KID), which explains the fund’s key features and charges. You must read this before you invest. If you’re investing in individual businesses, make sure you know what the company does and how it plans to make money in future.

If you look at the list of Warren Buffett, the majority of companies you should KNOW. Everybody drinks Coca Cola, takes a plane and uses a bank. Many American and people around the world buy an iPhone or a car of General Motors. Don’t make it complicated and invest in the companies that the majority of consumers use…

Rule 2 : Diversification

We all know the saying ‘don’t put all your eggs in one basket’, but it’s particularly important to apply this rule when investing. Spreading your money across a range of different types of assets and geographical areas means you won’t be depending too heavily on one kind of investment or region. That means if one of them performs badly, hopefully some of your other investments might make up for these losses, although there are no guarantees.

In Warren Buffett’s portfolio, the consumer defensive sector was placed first with The Kraft Heinz Co. (KHC) and Coca-Cola Co. (KO). In second place was the consumer cyclical sector, with General Motors Co. (GM) and Restaurant Brands International Inc. (QSR). Then you have the energy sector with Phillips 66 (PSX) , and Suncor Energy Inc. (SU).

The financial services, was represented by Wells Fargo & Co. (WFC) and JPMorgan Chase & Co. (JPM). The lone industrials representative is United Parcel Service Inc. (UPS). In total you have 7 different sectors that the portfolio is invested in. That is BEST INVESTMENT PRACTICE !

Rule 3 : Dividends

Warren Buffett knows that stocks with annual dividend increases not only hold up well during periods of volatility, but also act as a critical element of portfolio growth. Companies that increase their dividends regularly are relatively stable, competitively produce products and services needed by the public, maintain a strong presence in their markets, and are well managed. They have records of consistent earnings growth and adequate cash flow to easily cover their dividend and expansion needs. Although many companies pay dividends, only a relatively small number of them have maintained dependable dividend growth.

According to a recent study by Ibbotson Associates, from the end of 1925 through the end of 2005, large company stocks such as those included in the S&P 500 Stock Index had a compounded annual growth rate of 10.4%, including capital appreciation and reinvested dividends. If dividends are eliminated from this calculation, the annual growth rate of large company stocks was only 5.9% for the same 80-year period. By themselves, capital gains were only marginally better than the returns of long-term government bonds for the same 80-year period. The power of dividends is clear. That’s why you can also see 33 of the 48 stocks paying dividend in Warren Buffett’s portfolio.

Our view is that strong dividend growth stocks are long-term performance achievers with lower risk and volatility than non dividend-paying stocks. Dividends, we believe, are very important in the creation of wealth.

3. Final Words

If you take the time to review the above portfolio and learn the golden rules of investing, you can start to invest tomorrow.

In an ideal world, you’d be able to buy investments just before they increase in value and sell before they fall. However, no-one knows which way stock markets will move next, so trying to predict market ups and downs could mean that you end up buying or selling at just the wrong time. Never listen to media, that is for sure. Buying and holding investments can help you remain committed to your investments for the long term, avoiding panic decisions when markets are volatile. Over the long run, share prices follow value. Companies that are growing their profits and net worth will rise over time, whereas the share price of those companies who are performing poorly or making losses will eventually catch up.

Patience is the hallmark of successful investors — stock markets and individual company share prices can and do become irrational at times, and it is those times when investors take notice and act. If however you can’t identify opportunities to buy the shares of a great company at a significant discount, stay on the sidelines and wait.

This is the end of this blog post.

In 2019 we will send out ONE newsletter per month to our blog followers. Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe and you will get one email per month highlighting what you missed…

I realize I haven’t send out any newsletter yet but will try to do so for the May time frame.

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source : Seekingalpha

No Comment

You can post first response comment.