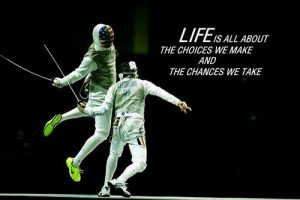

Eager to find a sport that challenges your child’s body AND brain? Curious about which sport gives your child the greatest chance of continuing to participate in college or secure a scholarship? Want to find a sport that is truly open to any child, regardless of body type, mentality, or temperament? Well friends, take a look at fencing. It seems to be the new sport for kids. One of our kids two years ago started with this sport. It was a big surprise that our son chose this sport.

“Fencing is truly unique in the way it challenges kids on every level,” says Michael Aufrichtig, who over the previous seven years has coached Columbia University’s men’s and women’s fencing teams to multiple NCAA championships in the USA.

“Aerobically, it can be very demanding – you use every part of your body. At the same time it forces kids to learn to think analytically – they need to observe, analyze, and adjust constantly, and very quickly.” In Belgium fencing is not that popular. It is unfortunate that parents in Belgium are NOT discovering that fencing is as much art as sport, that it not only gets kids off the couch and taxes them physically, but also forces them to dig deep for new modes of strategic thinking – strengths that will help them long after childhood is behind them.

“Becoming a fencer is a truly developmental process,” says Connie Shreiber, executive director of the Fencing Sports Academy. “The skills a child learns in fencing – in learning how to correctly assess what an opponent is doing and to adapt accordingly – will help them for the rest of their lives. It’s a definite confidence-builder. What truly sets fencing apart is the mental power demanded of its participants. “Thinkers,” says Papadopoulos, “often do well in fencing.”

So, what does thinking have to do with it? For starters, the fencing blade is considered the second fastest object in the Olympic games, trailing only a rifle’s bullet. This is why fencing often is described as chess – played at 100 mph. But it’s more than that, says Schreiber. “What matters in chess is where your move starts and ends. But in fencing, speed also must be factored in, and this adds a whole new dimension.”

Also like chess, experienced fencers will tell you that there is never one way to win a match. Even as a participant is analyzing her opponent’s strategy and adapting accordingly, her opponent is responding and reacting as well. Which is why, over time, fencers become increasingly analytical in their thinking – an incredibly important skill they’ll need later in life. So teenagers doing sports, shapes their different skills.

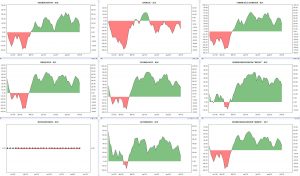

Market Sentiment and Sector Watch

The market sentiment as you can see in below graph is back bouncing after tech sector was leading the DOW recovery based on increasing stimulus bets. What is THE BIG picture: Even while the Fed frets about the durability of the U.S. economy, Americans are going on with their lives without too much worry. Spending is up, unemployment is low, incomes are rising and savings are near a three-year high. Apple askes their suppliers to raise their output with 10% so consumers are spending money for Apple products. Back-to-back negative economic reports, including from ISM, unnerved traders, resurrecting the narrative that the U.S. was set to join the global economic slowdown. Red flags were raised in particular when the ISM manufacturing PMI contracted for a second straight month. While the services index dropped as well, it remained in positive territory.

However, the case for continued growth was made on Friday when the monthly nonfarm payrolls report was released. Though job creation came in below expectations and average hourly earnings slipped, the U.S. unemployment rate fell to 3.5%, its lowest since 1969. This, more than anything else is what the Fed looks for, as a spur continued consumer spending growth, and what the country’s GDP relies on.

Nevertheless, speculation still runs high for another interest rate cut this month, even as the jobs release calmed growth fears, creating a dissonance in the market narrative. Lately, the market has been selling off on positive economic data, which is seen to reduce chances of additional Fed cuts, while rallying on negative data releases, viewed as increasing the outlook for lower rates.

The current narrative persists however, on expectations of further cuts after Fed boss Jerome Powell said that the economy “faces some risks” but is “in a good place” overall. Personally I believe there’s too much negative media while the central banks are doing everything in their power to create economic stimulus to support economic growth. It’s a dangerous game they are executing and I agree with some economists that the next financial crisis will be the one with the central banks.

Passive Income Update

During the month of September and october 2019, we received our monthly 20,78$ dividend and 116,24$ options premium. This brings our yearly total to 1439,96$. That is 144%. Our yearly goal was 1000 and we keep on adding cash to this portfolio.

![]()

So let’s review our Options Trade and where did we collect the options premium?

Options Trade review

Looking for an options trade on an ETF below 30$ and in the gold/silver sector, I was eyeing in the first place a Silver ETF that did have options to trade. My eye fell on the ETF with the ticker SIL. This ETF gives investors an opportunity to achieve exposure to silver without holding the physical metal or encountering the nuances of a futures-based strategy. For investors looking to bet on increased demand for a raw material used widely in various applications, SIL is a nice option. SIL often trades as a leveraged play on the underlying natural resources, meaning that this fund can experience significant volatility but can be a powerful tool for profiting from a surge in commodity prices.

So I sold a cash secured put at the price of 28$, a price I don’t mind owning a silver exposure ETF. The expiration date is the 18th of October. We will see if the price remains above this 28$ in the coming weeks. In the meantime we cash the money and add it to our cash position.

Going forward

So fencing or options/dividend investing are quite similar competences as you watch what opportunity there is to invest or trade in. Then you strike and add the cash to your portfolio. Now we don’t need to focus any longer on this portfolio. Our kids portfolio market value is around 13800 Euro. Our yearly goal has already been achieved. Nevertheless if we can add in the last three month another 200-300$ to our cash position, this would give us a good start position for the next year 2020. We also now receive from our JNUG position. We could have sold our JNUG position at the price of 100$ but we decided there is a bigger opportunity going forward… stay tuned.

This is the end of our blogpost. Did you realize more than 1000$ for your kids in 7 months ? No ? Then you should start investing in your own knowledge. Putting your money on a savings account is not a strategy to grow your kids money.

If you haven’t subscribed to our newsletter yet, please do so. Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe and you will get one email per month highlighting what you missed…

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source : Investing.com

No Comment

You can post first response comment.