Although May is full of public holidays, it is also a month full of business travel. The past week we spend a very busy week in Easton, Pennsylvania in the USA. That’s why I didn’t have time for my wednesday blog post. Anyways…do you know anything about the Lehigh Valley ? The Lehigh Valley has three main cities (Allentown, Bethlehem and Nazareth) and many small towns. It is 1,5 hour drive from Newark (New York) airport and there are 101 things to do.

Old factories, former garment mills, and an old book bindery are among Allentown’s industrial artifacts – all being reclaimed and reborn as apartments, offices, and restaurants, each helping to redefine the city’s skyline. Home to three historic districts, one of the best park systems in the country, and hubs for health care and e-commerce, Allentown no longer relies on the power of the Lehigh River to drive industry and trade, but instead, depends on devout hockey fans who flock to the PPL Center to see the Phantoms and fabulous concerts, diners willing to taste the culinary personalities of downtown restaurants, and visitors looking to spend the night in the aptly-named Renaissance® Allentown Hotel.

At the base of Bethlehem Steel’s iconic blast furnaces – now shuttered for 20-plus years – there is a sculpture, a public artwork that so perfectly symbolizes the city of Bethlehem. “The Bridge,” an arching band of steel reflects the city’s rich industrial history and the natural gas-fed blue flame is the light of revitalization, the promise of preservation and the commitment to put Bethlehem on the map where culture meets commerce. And, both Main Street and the South Side mirror that sentiment. Lehigh University and Moravian College are bookends to a diverse community of both pre-colonial heritage and a booming music scene. Turn toward South Mountain at the holidays where the star of Bethlehem honors the Moravians, the original titans of industry.

A vintage box of Crayola crayons contained red, orange, yellow, green, blue, violet, brown, and black wax sticks. But that’s not the only colorful fact you can learn on a visit to Easton. At the confluence of the Delaware and Lehigh Rivers, visitors come to the charming riverside town to take in the vibrant greens of heirloom veggies at Easton Farmers’ Market, root for the Lafayette College maroon and white and debate the age-old controversy about the Easton flag: did its 13 white, eight-pointed stars and red and white stripes predate the one made by Betsy Ross?

As I travel often to this region, I have visited the three cities several times. Mainly for dinners in a restaurant. Not so much as a tourist during the day 🙂

During my business travel I read my financial newspaper online or using my ipad. I noticed the following headline.

Belgians are mainly investing in the stock market because they consider the pension too low when they retire. 66% of the investors say to invest for future retirement. 89% of the investors do not want to become dependent financially on their kids or family. Also 61% wants to help their kids to buy a place to live. To make all those ambitions come true, saving and investing for the long term is inevitable as other asset classes offer low returns on investment. Around 69% of the investors assumes an average yearly return of 5% for the coming 10 years.

The pension today is around 1270 Euro and is definitely not sufficient for retirement. An increase to 1500 Euro would cost 2 billion euro, a minister recently said. So save for your retirement using the stock market is the key message. Please know that only 35% of Belgians are investing in the stock market today by using mutual funds, ETFs, Stocks or any other derivatives. So there is still a big learning curve for many of the Belgians…

Market Analysis

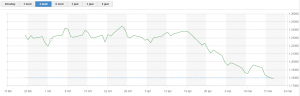

When we analyse the performance of the SPY (screenshot 20 May) we noticed a retest of 260 support level on the 3rd of May and then we bounced back up. Investors came back in and bought into this market. Since that 3rd of May we have seen a strong direction upwards….and we bounced against that downtrend channel.

What we did notice past week, was the outperformance of the small caps Russell index. Small caps are now clearly leading the markets higher. Roughly 10% of industry groups are significantly outperforming the main indices. Take a look at the breakout of the IWM ticker. We broke the resistance level.

Can we breakout further to the upside higher ? Negative news such a tensions with North Korea and other stock market risks such as a trade war with China is disappearing. Earnings seasons was filled with many great outperformance results of companies such as Amazon and AliBaba. The US economy is in good shape.

So with the small caps leading the markets higher and the trade wars going away investors start to believe in a higher uptrend of the stock market.

If we break in the coming month the 274 level of the SPY, we can look forward to the resistance level of 280.

Let’s dive in the numbers of my April Dividend & Options Income Report.

Options Income & Dividends received in April 2018

In April 2018 we received a total of 606,11 $ passive income. We received 288,98$ dividend income from monthly paying stocks or ETFs and 317,13$ from quarterly ETFs. No options income this time again as we are transferring our portfolio to a new broker. This has not been completed.

Below you see the monthly summary overview of the cash flow coming into my bank account.

![]()

Portfolio Analysis and Growth

So far we have 2870,71$ passive income for the year 2018. Last year we received around 1k more in dividend income as we owned a lot of quarterly paying ETFs. Now we are 1100$ behind compared to last year. Can we catch up going forward ? We will see…

![]()

We have 29% of our yearly objective in the books.

The Euro/Dollar trend

We keep on following the EURO/USD valuation. The USD did find a trend higher and is only a few percent before resistance. A higher dollar works in favor of our portfolio.

The USD dollar is back at the same level as December 2017.

Going forward

The last months we have been focussed on my mom’s and my kids’ portfolios. This resulted in a record month within my mom’s portfolio in April. We keep on executing options strategies in my mom’s portfolio and now we have done the same within the portfolio of my kids. We hope to complete the transfer of my portfolio as soon as possible so we can trade options again.

Did you notice something new on the right side of our blog post page ? We are now part of the European Firehub community and part of the Modest Money and Rockstar Finance blog listings. Great to be part of a community !

What do you think about our monthly performance ? Did you receive equal cash flow money on your saving account ? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! Thanks for following us on Twitter and Facebook and reading this blog post. As always we end with a quote.

Sources : De Tijd

No Comment

You can post first response comment.