First week of December is already behind us and the first snow kicked in giving our garden and the country a beautiful snow carpet. It’s time to plan the last activities of the year 2017. Past week I did work mainly on my last Financial Education class for the kids. Before the year end 2017, I want to give the kids this last financial educational lesson so that they can start 2018 with a financial literacy basic knowledge. This is definitely one of my 2017 Objectives that I want to check as DONE from my Objectives list.

My mom did not travel in November 2017 but she is making big plans for 2018….she is planning trips to countries she has never been before. What did caught my attention in November 2017 ?

What’s new in November 2017 ?

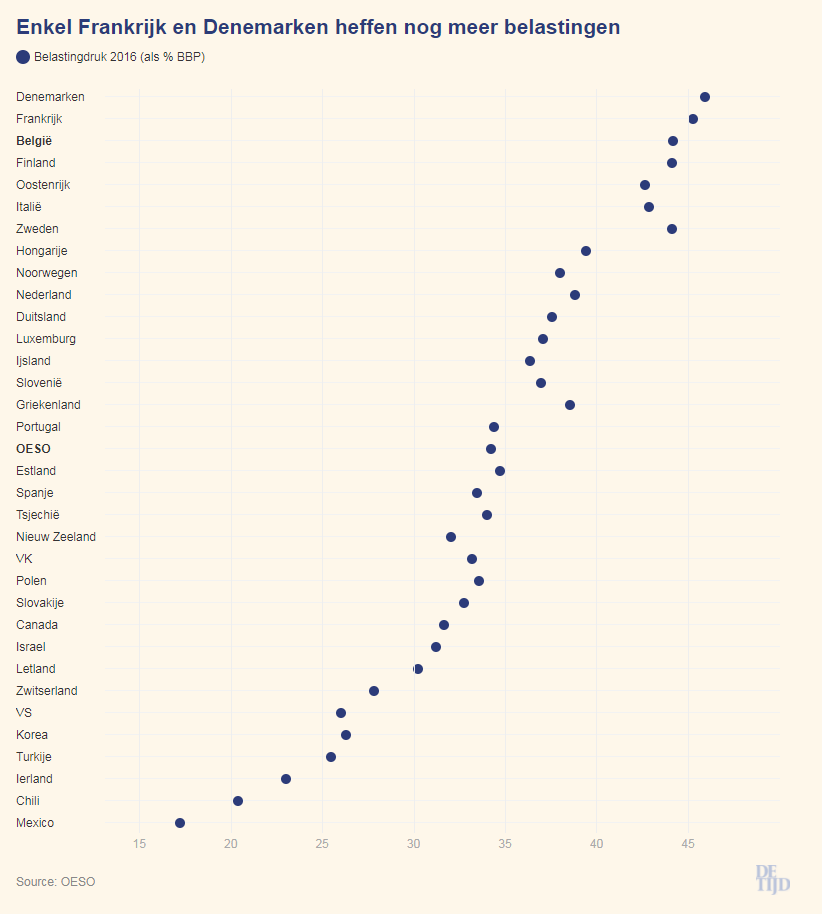

First I want to bring your attention to the OESO report that was published in November. According to OESO, Belgium owns the third place of TAXES % in the world. Only Denmark and France take more money from your paycheck. With a tax pressure of 44,2 % Belgium is way above OESO average of 34,3 %.

A study of consultancy firm PwC shows that Belgian companies are amongst the highest taxed from Europe. The gap with other European countries is big !!

The second topic that caught my attention last month was the article “Belgian Government sets up TRAP for pension saving people”. Next year Belgian government will have an additional pension saving system with tax deduction. There will be three possibilities to save money for your pension :

- 940 Euro with 30 % tax deduction

- 1200 Euro with 25 % tax deduction

- Anything in between…

If you save 1200 Euro, you save more money for your pension but concrete you only keep 18 euro after tax deduction. Does the government think people are stupid ? According to financial forecasts of Belgian government, the government expects 15% of the saving people to chose this new system of 1200 EURO. If you chose for a money amount between 940 and 1200 euro lower than 1128 euro, you actually LOSE MONEY ! Secondly when you put more money in the system, you assume that the bank will grow your money as a good money manager. Have you seen the % performance returns of pension funds the past years ? They definitely do not outperform the market.

I will tell you what I will do. The BARE minimum SAVING which gives me the MAXIMUM TAX BENEFIT ! The difference I will put on my investment account and I will INVEST the money MYSELF ! I am not falling in this government and banks lobby trap !

Another interesting article highlighted the fact that Belgian people GO EARLY in retirement compared to the international average. Werken tot mijn 67 ? The Pic Werken tot mijn 67? Vergeet het …can be translated as ” Work until my 67? Forget it ! Belgian men went last year in retirement at the age of 61,3 years old, women at the age of 59,7 years. Alone in France, Slovakia and Luxemburg men go earlier in retirement.

The official pension age is in the most OESO countries 65 to 67 years old. Germans, Dutch and also British people work longer and in most cases until the official pension age. In some countries such as South-Korea, Mexico, Chili and Japan men work on average until the age of 70, but also in Portugal and Ireland people work beyond the official pension age.

When people retire early, it means that they need to live a long time from that government pension. For women that is on average more than 26 years. For men it is on average 21,3 years old. The OESO average is 22 and 18 years. Belgian 65 year old people are amongst the most dependent on the government pension within Europe. More than 84 % of their income comes from the government, although the official pensions are not the highest in Europe. It does not even cover the costs of a pension home…

Please bear in mind that you can still lose all your net worth when you retire and also make your kids poorer. Read a blogpost I wrote about that earlier in the year.

Now you can read our Dividend Income November 2017 Report Out for my mom’s portfolio.

Dividends received in November 2017

During the month of November 2017, we received 124,68$ dividend income coming from 4 different monthly dividend paying stocks and ETFs. More than the 100$ monthly goal. One more month to go…

Here you find the overview of all dividend payouts during the year 2017 compared to 2016.

![]()

Portfolio management

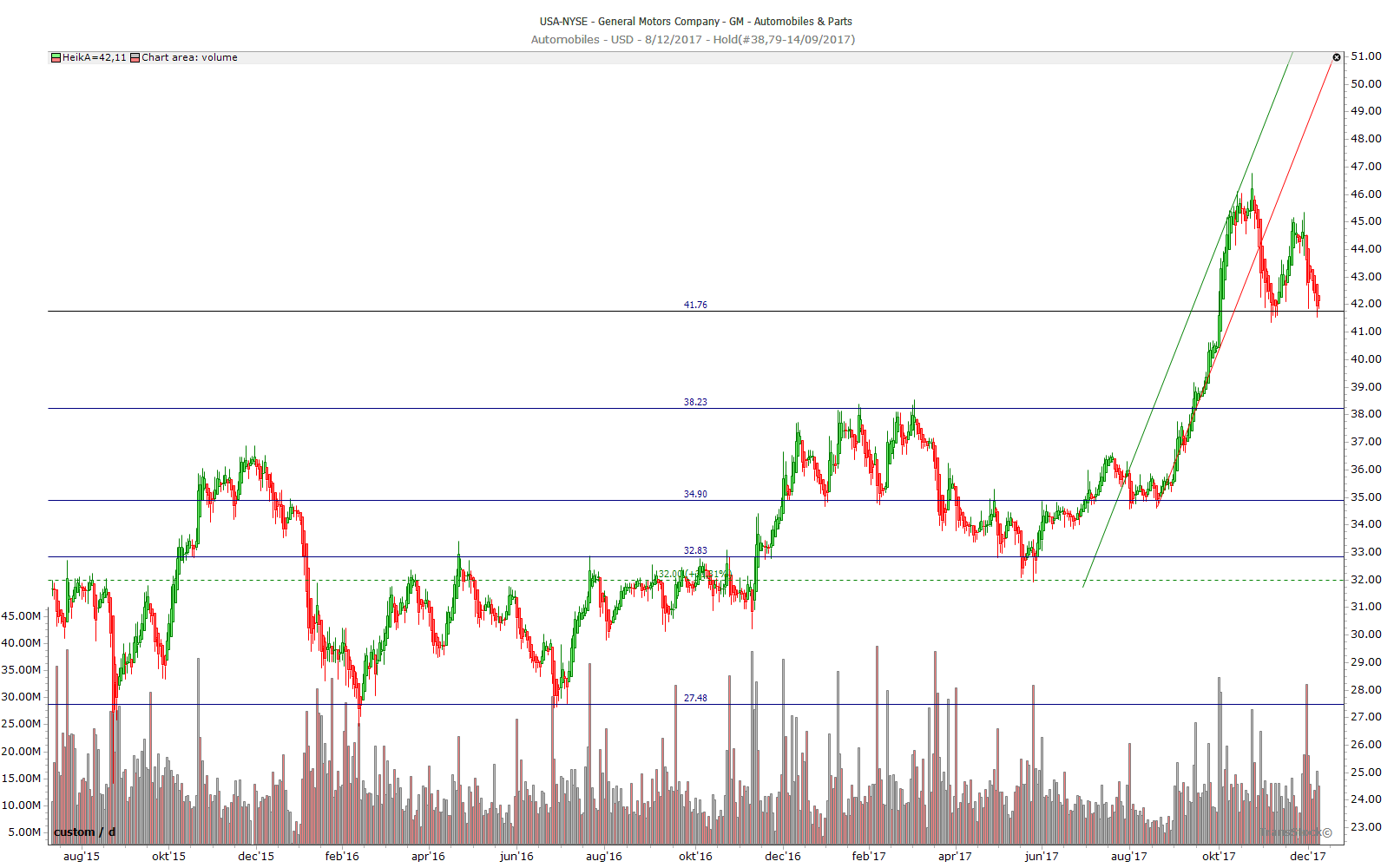

Last month we wrote about an options play with GM. Well..if you took the trade, you would have made a nice profit. The worst case scenario that could have occured if GM would have fallen below $40 by expiration, is that you would have to buy the stock for a cost basis of $39.50. Based on the hefty amount of support in that area I still think it’s a great price to initiate exposure. Due to heavy business travel, I didn’t take the trade. I know some investors who got a nice paycheck from this trade on weekly options. Take a look at the chart. GM did not break the 42 $ level.

Dividend Income Growth

My mom’s dividend income is now growing above the 2000$ mark. We have now a total of 2135,91$.

We have now 178% of our yearly objective.

![]()

Going forward

We still have cash available for new purchases and we continue to look for new opportunities. We stay prudent in today’s markets as I see many factors that can trigger a stock market correction.

How was your month of passive income? How do you generate money for your retirement? Let us know….

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

One Response Comment

Excellent, keep up the good work. Keep that trending upwards!