For the past 4 years we have been investing money and generating cash flow for my mom’s portfolio. In total this has generated more than 6.000$ cash using dividend stocks and ETFs while writing puts with the cash balance.

For the past 4 years we have been investing money and generating cash flow for my mom’s portfolio. In total this has generated more than 6.000$ cash using dividend stocks and ETFs while writing puts with the cash balance.

In December my mom had a lot of bills to pay and she requested me to get a pay-out from the portfolio. All the rest of her “investments” are on savings accounts LOSING MONEY but she doesn’t have any financial literacy and doesn’t understand the inflation beast eating money.

So we paid out 2.500 EURO from the cash generated from the portfolio.

So let’s get back to my view on the stock and forex market…

Will the following expression become true ? “When the U.S. sneezes, the rest of the world catches a cold”

In economic terms this means when an outbreak of coronavirus grinds the world’s second-largest economy to a halt, the rest of the world catches a recession.

According to Mark Decambre (Twitter @mdecambre), recession fears resurfaced on Wall Street last week, even as equity markets stood not far from all-time highs, amid volatile trade that whipsawed mostly on jitters that supply chains and economies could suffer from the spread of the infectious illness that originated in Wuhan, China, known as COVID-19.

“The [coronavirus spread] definitely injects an element of uncertainty into markets for the near term and for the longer term as well,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management.

Analysts at BofA Global Research said the probabilities of a recession have increased and that is reflected in the action in long-bonds like the 10-year Treasury note and the 30-year Treasury bond, which plunged Friday to its lowest rate on record. Investors will flee to the presumed safety of U.S. government bonds, driving yields lower, with the hope of avoiding losses that can derail riskier assets in a selloff.

Amid all this recession talk, Gold has been on a tear. The precious metal often draws heavy bids during market uncertainty. Last week, it gained 3.9% to settle at $1,648.80 an ounce, marking the sharpest weekly rally since the week ended June 21, according to FactSet data. Investors couldn’t stop talking about the shiny yellow metal, even through it’s unclear if those bets will pay out over a longer term. In my mom’s portfolio, we are invested for the long term in gold and silver ETFs.

Even so, the Fed doesn’t yet seem inclined to lower rates to placate nervous investors. Vice Chairman Richard Clarida said the central bank is unlikely to lower interest rates given the positive economic outlook. On CNBC on Friday, Atlanta Fed President Raphael Bostic and St. Louis Fed President James Bullard appeared to be sanguine about the health of the U.S. economy, even as they watched corona virus closely.

BMO’s Ma said that those takes may be justified because the health of the domestic economy doesn’t appear to be one genuinely signaling that a recession is afoot.

Corporate earnings for one have been mostly solid. “Q4 results came in better than expected, rising 1.6% versus the expected 2.1% decline, representing the 32nd consecutive quarter in which actuals beat end-of-quarter estimates,” said Sam Stovall chief investment strategist at CFRA Research.

However, he said the outlook was softening, noting that “2020 forecasts are now at 5.9% versus the 7.9% at the start of the year.”

Corona virus is the likely culprit and the disease derived from the novel strain has more consistently given investors pause headed into the weekend. That seems like an odd statistic but it’s telling about investors willingness to hold on to assets they consider risky amid the developments around the infection.

Also in the video of Specialist Share Education, Gary states that the corona virus is a media event and we need to look at the big picture. Let’s continue to follow the trend. We could end in a consolidation zone, but this is not a correction ! No!

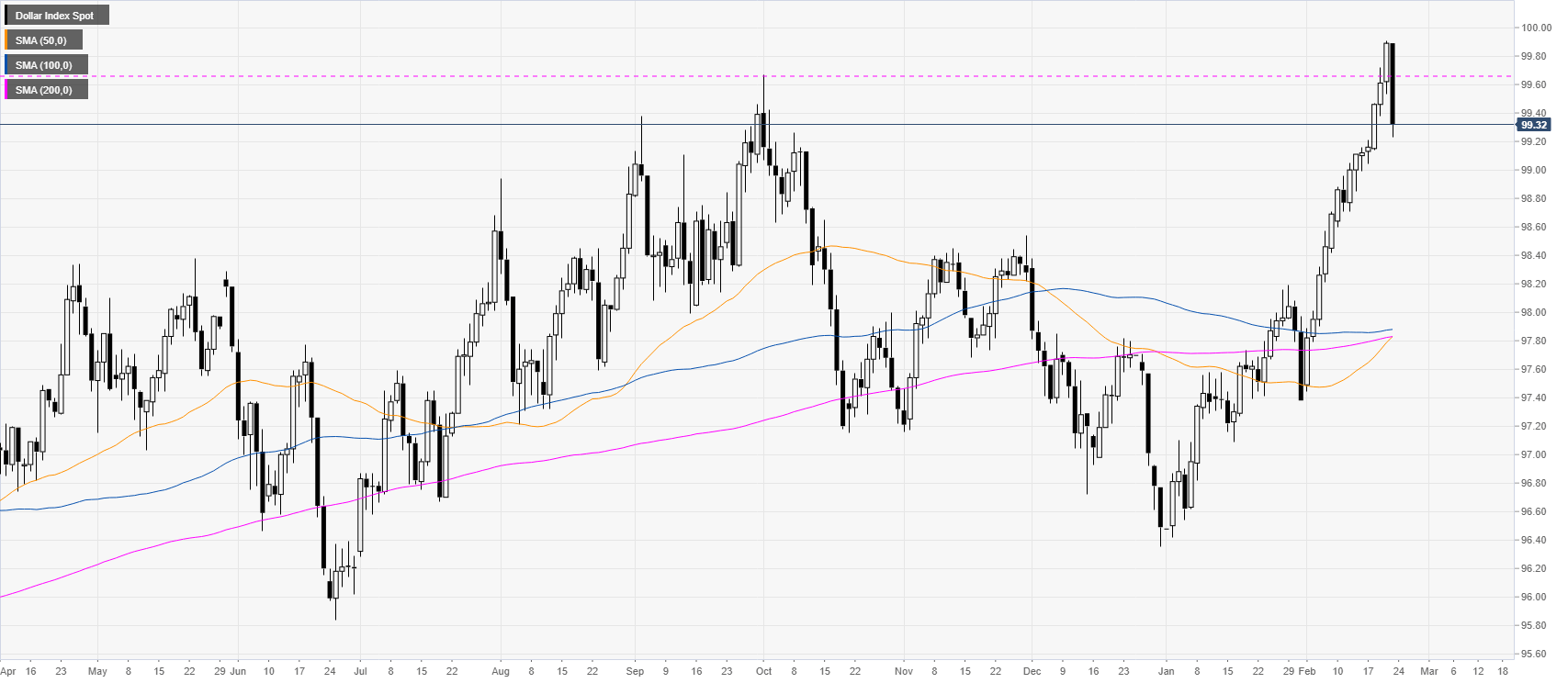

The US dollar index fell sharply on Friday and tested the 50 Simple Moving Average (SMA). The trend remains bullish however a deeper pullback cannot be ruled out. Bears can try to break below the 99.20 support and generate an extension down towards the 99.00 and 98.80 support level. A resumption of bullish movements can find resistance near the 99.40 and 99.65 levels. The US economy and as a result the USD dollar remains strong and we will monitor the markets/currencies going forward.

Now let’s see what our January cash flow was for my mom’s portfolio.

Passive Income in January 2020

During the month of January 2020, we received in total 285.67$ passive income. Only dividend income as we didn’t execute any options trades. Actually with the payout of 2500 Euro to my mom, the cash position is too limited to write put options. That’s a pity as last year we earned 500 Euro thanks to writing some put options.

Here you find the overview of all passive income payouts during the year 2016, 2017,2018,2019 and 2020.

Going forward

As we currently have no longer a cash position, we need to figure out a strategy to generate more cash without having money…is that possible ? We can’t sell secured puts as we don’t have cash to cover our positions. We could possibly sell naked puts but that’s a strategy that involves risk which I prefer not to apply in my mom’s portfolio.

We will investigate the coming 2 months what strategy we can apply…Stay tuned !

In January 2020 we did send out our first Monthly Newsletter. We will continue to do so at the end of each month. Life can be busy sometimes and people lose track of following a personal finance and travel blog. Subscribe and you will get one email per month highlighting what you missed…

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source : Market Watch

No Comment

You can post first response comment.