May 2018 with lovely spring weather has arrived in Belgium but my mom decided to travel again. This time she picked the Italian riviera as her final destination. The featured picture for this blog post comes from the town Imperia in Italy.

Imperia is a lovely coastal city on the Liguria coast between the French border and Genoa. The city was formed by grouping Porto Maurizio, Oneglio and some surrounding villages in 1923 at the decree of Mussolini.

The pretty, touristic side of the city is based around Porto Maurizio whilst Oneglio is more devoted to the production of olives and flowers. Between the two centres is the river Imperia after which the city was named.

Take a look at the website GoImperia.com.

There are some nice videos on this website including all information you need to know for booking your travel to Imperia. So let’s move on. I always start with a reflection on what I learned during the past month…

What did caught my attention in March 2018 ?

What was new in March 2018 ?

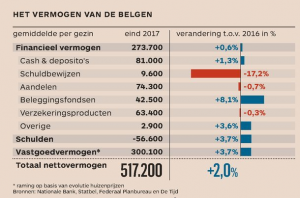

Saturday the 31st of March, the financial newspaper De Tijd posted the following headline “For first time since financial crisis Belgians are savings more”. As you can see on the graph, the % of savings per family income has declined over the years. Belgians saved 11,3% of their income last year. Little higher than 2016. The increase can be explained by an higher income thanks to dividends. The interest rates of a savings account has only declined over the years. Also bonds, and other asset classes declined except stocks with dividends.

On average an European family did save last year 12% of the yearly income. 0,7% more than a Belgian family. Did you save 11% of your yearly income ?

Did the net worth grow of a Belgian family ? The net worth of a Belgian family did grow with 2% which was lower than the 2,1% inflation. The Belgians did NOT get richer as a result.

The net worth growth was limited because Belgians did not invest savings money in investment products such as stocks, funds and ETFs. They blindly kept on putting money in their savings accounts. The debt of Belgians on the other hand did increase with 12 billion to a high of 279 billion.  More people invested in real estate and increased their debt ratio compared to their monthly income.

More people invested in real estate and increased their debt ratio compared to their monthly income.

The average Belgian family does have a net worth of 223.800 Euro if you divide all net worth by the population of Belgium. If you exclude the multimillionaires in Belgium and calculate a more accurate average, the median of a Belgian’s family net worth would be 341.000 Euro.

Do you have an accurate overview of your net worth ? I do a yearly review of my net worth and evaluate whether it does increase or decline.

Now you can read our Dividend & Options Income April 2018 Report Out for my mom’s portfolio.

Dividends & Options received in April 2018

Did you notice that I change the title of this section this month? Yes or no? This month we received our FIRST options income within our mom’s portfolio.

During the month of April 2018, we received 234,46$ dividend income coming from dividend paying stocks and ETFs. It is below the 290$ monthly goal that we did set as the 2018 objective. But we received 591,48 $ options income. HURRAY !! More than double than our dividend income. Read our new section Options Trade Review to learn more about it.

In total we received a passive income of 825,94 $ for the month of April. A new monthly record !!

Here you find the overview of all dividend payouts during the year 2016, 2017 and first months of 2018.

![]()

The Options Trade Review

During the month of March I was keeping an eye on the gold miners sector as I described in our blog post Sector Watch & My Kids Portfolio : February 2018 Dividend Income Report.

I was very interested in the chart of NUGT and JNUG. Why? What do you see when you look at a 3 year chart of the junior gold miners ETF ? The stock price has been bottoming between 12 and 13 $ and has not gone below that.

Take a look at the gold miners ETF with the ticker NUGT. Same story where the stock price has not gone below 21 $. And the stock price bottomed between 21 and 22$.

So I decided to sell several options contract with a strike price of 13$ for JNUG and strike prices 22$ and 22,5$ for NUGT. I received an options premium of 591,48$.

What was my risk in doing those trades ? Worst case the stock price of NUGT did fall below 22$ and I had to purchase stocks of NUGT at 22$. Same story for JNUG below 13$. The stock price never dropped below the strike prices and the options contracts expired worthless and I did keep the money in MY pocket. Actually in my mom’s pocket !!

What a great start of the options investing strategy, don’t you agree ? Above you find the screenshot of the trade one day before expiration. A 100% win !!

Dividend & Options Income Growth

April 2018 boosted really the passive income within my mom’s portfolio. After 4 months we have 45% of our yearly objective and generated 1583,87$. We did grow our passive income from 22% last month to 45%. We are on track to meet our yearly objective.

![]()

Going forward

We keep on improving our skills on finding the right options investing trades and dividend paying stocks. The 825,94$ covers the travel expenses that my mom is doing at the Italian coast. Isn’t that great news ?

We need to improve our monthly consistency and also our monthly dividend payouts going forward. I am reluctant now to invest in dividend paying stocks as the stock market is choppy and has not chosen direction yet. Are we going up or down or sideways ? If there are opportunities to buy a high yield dividend paying stock at low price, we won’t hesitate to add to our portfolio.

Keep investing in your knowledge and results will follow as you can see during this month.

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

3 Response Comments

That is some amazing start with options , cool!

Congrats on your progress so far. Amazing to see your dedication!

Nice article! I expected more about the travel and how the money applied to the travel lol. Saw the headline you wrote in the twitter article. Didn’t realize it was Money from options trading AND dividends. That’s awesome!

-Jack

Thanks Jack !