21 March and we are writing this blogpost from the city of New York city. Yesterday we visited a great location Classic Cars Club in Manhattan, NYC. It is a private club for wealthy people who want to drive a special car when they want. Clubhouse membership includes full access to all of the member facilities at Pier76 as well as the Club’s entire calendar of events, both here and abroad. Come race on track, rally through France, entertain friends at the club’s restaurant or draft for speed on a cycling team. Race, rally, dine, drink, podium, road trip, kick back and live adventurously. We did see a lot of beautiful cars and please check out the website for more information on the club membership offerings.

The year moves forward quickly and my health has improved. I still haven’t fully recovered from my blockage of a nerf. Today I still struggle with some stretch pains in my left arm and hand. Due to the high stress level on my muscles, the physician is working on doing a “reset” on the muscles that were impacted. Getting fully healthy is my priority number 1.

In last month blogpost of My portfolio, I wrote about the inheritance taxes in Belgium. The Flemish government decreased the taxes and the highest tax rate of 65% disappears. Common sense prevails. Look at below graph and you will understand that Belgium had the HIGHEST revenue from inheritance taxes. Not something to be proud about, isn’t it?

‘We lower the taxes as promised and lower the taxes on sorrow’, said the responsible minister. Well…it was about time to do so !

Last week the financial newspaper reported also that banks are charging more and more fees to their customers. From the year 1998 to 2017 the banking fees have increased more than 80% while the inflation only increased 46%

The latest 4 years the increase is 3 to 4% per year. Due to low interest rates, banks seek other revenue income and charge more towards their customers. An average Belgian pays 51,6 Euro banking fees per year. The bank Argenta does not charge anything, but the service is limited. Other banks charge up to 500 Euro…watch out for those banking fees as this is a HUGE difference. At Keytrade bank you get 0,05 Euro PAID on your bank account for each bank transaction…Chose wisely your bank for doing your regular payments and put that money in your pocket ! I never pay for banking services and save a lot of money as a result !

So let’s go towards to our Market Analysis.

Market Analysis

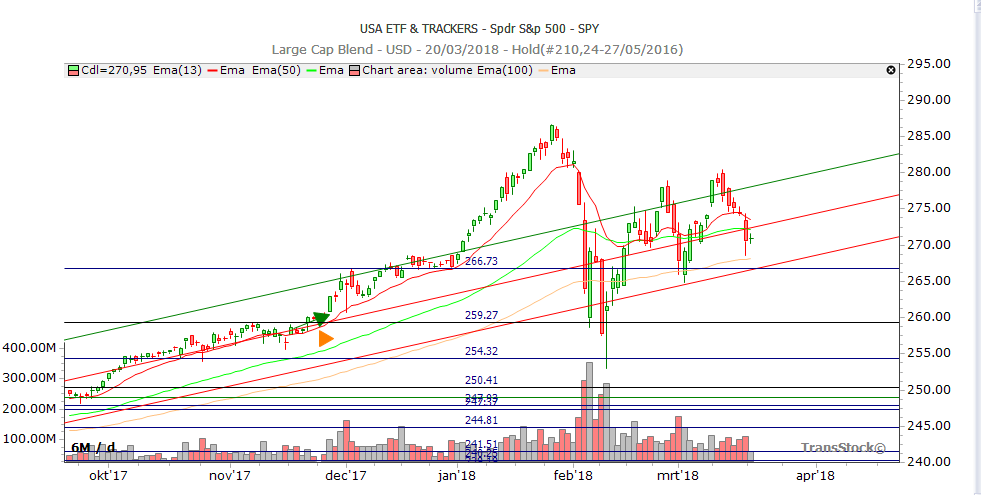

When we analyse the performance of the SPY (screenshot 21 March) we can conclude that we have entered a volatile period. Yesterday we saw a sharp selloff of Facebook shares fueling a sell off. Tomorrow wednesday we have the first speech of Fed Chairman Powell. Will there a interest rate hike? The central bank’s rate-setting Federal Open Market Committee, or FOMC, which is widely expected to deliver a quarter-percentage rate increase, is unlikely to be as hawkish as most market participants seem to expect, according to Neil Dutta, head of economics at Renaissance Macro Research.

The Fed funds futures market is currently pricing in three rate increases in 2018, the same as the Fed policy makers are projecting, but investors worry that the FOMC, which is viewed as decidedly more hawkish than last year’s lineup, may signal a fourth hike is in the offing via their so-called dot-plot forecast. We will see and act accordingly.

Last month I wrote that we can remain in that trend channel and we have been doing so far. The 100 EMA line has not been broken (so far). Until the end of the year I expect a lot more volatility and we invest time in learning options strategies on how to benefit from this volatility.

Let’s dive in the numbers of my February Dividend Income Report.

Options Income & Dividends received in February 2018

In February 2018 we received a total of 682,05 $ passive income. We received 282,18$ options income and 399,87$ dividend income from monthly paying stocks or ETFs. That is more than 2017 February passive income thanks to our options income. Great !!

Below you see the monthly summary overview of the cash flow coming into my bank account.

![]()

Portfolio Analysis and Growth

So far we have 1732,31$ passive income for the year 2018. Not a bad start but last year we had after two months 1954,05$ after 2 months. So we are 221,74$ behind compared to last year if we put our passive income in a bigger perspective.

![]()

We have 17% of our yearly objective in the books and we can’t complain about that. We achieved two months our monthly objective of 300$. Let’s make sure we can execute this same trend in the coming months.

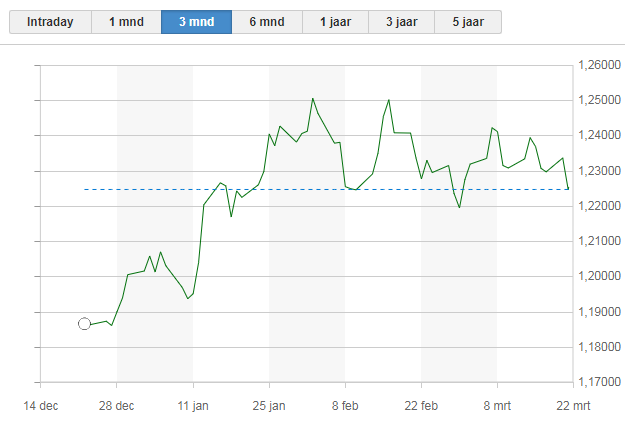

The Euro/Dollar trend

We keep on following the EURO/USD valuation. The Dollar became little stronger and some analysts predict parity in the coming months.

Going forward

In the coming months we keep on learning options strategies and how to generate cash flow from options. Our primary goal is to generate consistently cash flow month after month out of the stock market.

What do you think about our monthly performance ? Did you receive equal cashflow money on your saving account ? Don’t hesitate to leave your comments and feedback. Let us know what you think.

Good luck with your personal finance strategy! As always we end with a quote.

Sources : De Tijd

No Comment

You can post first response comment.