What has dominated the news yesterday and will dominate the news today ? The midterm elections in the USA is the number ONE news item in the world. But what do the midterm elections mean for the markets?

Here a recent article from OppenheimerFunds caught my attention. This article has some interesting graphs I want to share and comment on.

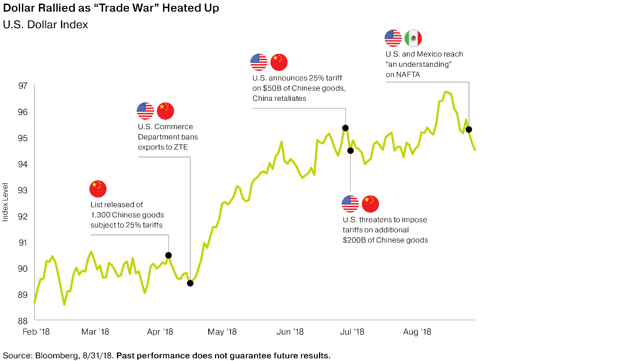

But what does this mean for the stock markets ? Changes in Washington have not historically impacted long-term performance. The U.S. stock market in recent months has reached all-time highs. At the same time, trade wars are weighing on sentiment globally leading to correction.

Historically, the Market Performs Well After Midterm Elections

Regardless of party affiliation, investors may try to gauge what will happen on election night and whether to make any adjustments accordingly. According to Oppenheimer the good news, from a financial perspective, is that historically midterm elections have not had a major impact on the financial markets or provided reasons for investors to make major changes to their investment plans. It’s critical to take a step back and let history be our guide.

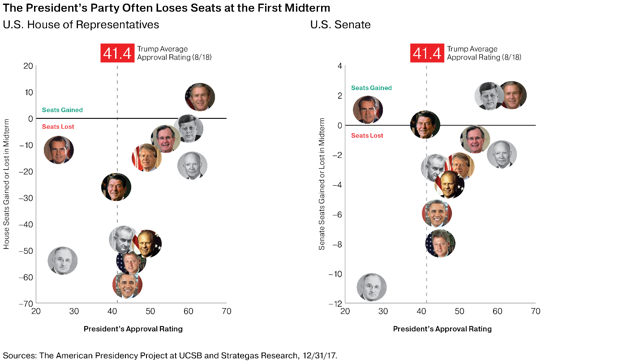

Midterm elections are rarely kind to the political party of the sitting president. 2018 has not been different. Presidents have almost always dropped House and/or Senate seats in the first midterm election, with only a few exceptions. George W. Bush, in the aftermath of 9/11, was the only president able to pick up both House and Senate seats. The number of seats lost often correlates with the president’s approval rating. Less popular presidents have lost upwards of 40 House seats and four Senate seats, while popular ones have been able to stem the losses.

Markets Even Seem to Prefer a Divided Government

Investors fear that a divided government—with a Democratic-controlled House of Congress in opposition to a Republican administration—could derail President Trump’s agenda and put an end to the historic bull market. But throughout history, markets have often performed better with a divided government.

While changes in Congress could lead to more legislative gridlock, the President’s ability to act independently may influence markets more. Of course, the elections will impact what policy decisions can be made. Since taking office, President Trump has signed over 175 bills into law including the landmark Tax Cuts and Jobs Act. If Democrats take control of even one chamber of Congress, it will be difficult for the full Republican agenda to be enacted.

Regardless of the makeup of the House though, the President can still influence policy such as trade agreements by issuing executive orders. The prospect of tariffs and a strong U.S. dollar is a risk to global growth.

Read this LAST sentence again. More tariffs and trade wars are a risk to the stock markets.

Policy Decisions do have an impact on sector performance over the short term. If you want to know which sectors, click the link next to the Source to read the full article. What is the bottom line here that I want to pass on to you? Political surprises and machinations may have short-term market implications but have proved to be mere blips in the long-term advance of the market.

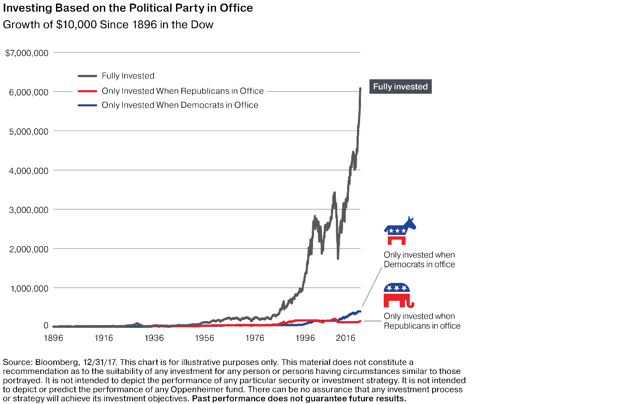

The market has weathered “unique” political environments before, and the past has generally demonstrated the value of developing a long-term plan and sticking to it, regardless of who is controlling Washington. Check out below graph if you had invested 10.000 $ fully invested since 1896 in the Dow. You would hit the 6 million dollars…what do you think about that?

Now let’s see what our October 2018 cashflow was for my mom’s portfolio.

Passive Income in October 2018

During the month of October 2018, we received 235,18$ passive income. Only dividend income.

Here you find the overview of all dividend payouts during the year 2016, 2017 and first months of 2018.

![]()

The Options Trade Review

No options trades this past month.

Dividend & Options Income Growth

October was a month where a lot of things have been going on. We have 59% of our yearly objective. We crossed again the 2000$ mark which is nice. We didn’t achieve our monthly goal of 290$.

![]()

With a monthly payout of around 120$ we would end around 2.300$. This would mean we are still 1200 short on our yearly objective.

Going forward

Now that the midterm elections are out of the way, investors will again focus on the key elements driving this market. We could see a year end rally into december. However this can only happen if the impact of more protectionism policies remain limited on the global growth. Remember we are on the last legs of this economic growth cycle. At least that is what is everybody saying…will it be 1 or 2 years..who knows?

Can I make 1200 extra cash flow during next two months in my mom’s portfolio ? I believe it is possible with options strategies. But do I have the required skills yet to do so ? We will take small steps to get there. We are not gambling with my mom’s hard earned money.

Stay tuned and we will tell you all how we progress !

Thanks for reading.

Thanks for following us on Twitter and Facebook and reading this blog post. We end with a quote as always.

Source : Seekingalpha OppenheimerFunds

No Comment

You can post first response comment.