On friday 26th of May, an article in the financial newspaper De TIJD caught my interest. It had the title “Flemish student scores well in financial literacy”. As one of my goals of this blog is to teach everyone about personal finance, I was interested to read about the financial literacy and conclusions from this study. How deep did this study go? What were the questions asked ? What were the conclusions ? And last but not least “what can we learn from it?” to take forward in our parental role for teaching our kids financial literacy.

So I started to read the article of the journalist Barbara Moens but I also read the overall PISA report and their presentation. This information gave some really nice insights which we share with you below.

PISA in brief

The OECD Programme for International Student Assessment (PISA) examines not just what students know in science, reading and mathematics, but what they can do with what they know.  Results from PISA show educators and policy makers the quality and equity of learning outcomes achieved elsewhere, and allow them to learn from the policies and practices applied in other countries. PISA 2015 explores students’ experience with and knowledge about money and provides an overall picture of 15-year-olds’ ability to apply their accumulated knowledge and skills to real-life situations involving financial issues and decisions. In Belgium the analysis was performed by the University of Ghent. Here’s the URL : http://www.pisa.ugent.be/nl

Results from PISA show educators and policy makers the quality and equity of learning outcomes achieved elsewhere, and allow them to learn from the policies and practices applied in other countries. PISA 2015 explores students’ experience with and knowledge about money and provides an overall picture of 15-year-olds’ ability to apply their accumulated knowledge and skills to real-life situations involving financial issues and decisions. In Belgium the analysis was performed by the University of Ghent. Here’s the URL : http://www.pisa.ugent.be/nl

Over the past decades, developed and emerging countries and economies have become increasingly concerned about the level of financial literacy of their citizens, particularly among young people. This initially stemmed from concern about the potential impact of shrinking public and private welfare systems, shifting demographics, including the ageing of the population in many countries, and the increased sophistication and expansion of financial services. Many young people face financial decisions and are consumers of financial services in this evolving context. As a result, financial literacy is now globally recognised as an essential life skill.

Some 48,000 15‑year-olds took part in the test, which evaluated the knowledge and skills of teenagers around money matters and personal finance, such as dealing with bank accounts and debit cards, or understanding interest rates on a loan or mobile payment plan. This is the second time PISA has been used to assess students’ ability to face real-life situations involving financial issues and decisions. These teenagers represent approximately 12 million 15 year old teenagers. Besides the test that consisted of 1 hour computer test with 43 questions, students had to complete a questionnaire about themselves, their family situation, their school and their experiences related to financial matters.

* Participating countries and economies: Australia, Belgium (Flemish Community), Brazil, Canada (British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island), Chile, China (Beijing, Shanghai, Jiangsu and Guangdong), Italy, Lithuania, the Netherlands, Peru, Poland, the Russian Federation, the Slovak Republic, Spain and the United States.

You can find a Dutch PISA video on following URL PISA introductie

You can find the official PISA website on following link : http://www.oecd.org/pisa

Why is financial literacy important?

Young people today face more challenging financial choices and more uncertain economic and job prospects given rapid socioeconomic transformation, digitalisation and technological change; however, they often lack the education, training and tools to make informed decisions on matters affecting their financial well-being,” said OECD Secretary-General Angel Gurría, launching the report in Paris with H.M Queen Máxima of the Netherlands, the UN Secretary‑General’s Special Advocate for Inclusive Finance for Development and Honorary Patron of the G20 Global Partnership for Financial Inclusion. “This makes it even more important that we step up our global efforts to help improve the essential life skill of financial literacy.”

Everywhere, people face more challenging financial choices. The spread of digital financial services opens up new opportunities for people once excluded from the financial system; but the digitised system also exposes consumers to new security threats and risks of fraud that are compounded when low financial literacy is combined with poor digital skills and ignorance of cyber security. There are also greater financial risks. More individualised pensions, and more uncertain economic and job prospects due to digitalisation, technological change and globalisation are just some of these. Last but not least, growing inequality means that those with poor skills face particular risks.

So what were the conclusions of this global survey?

Global conclusions from PISA 2015

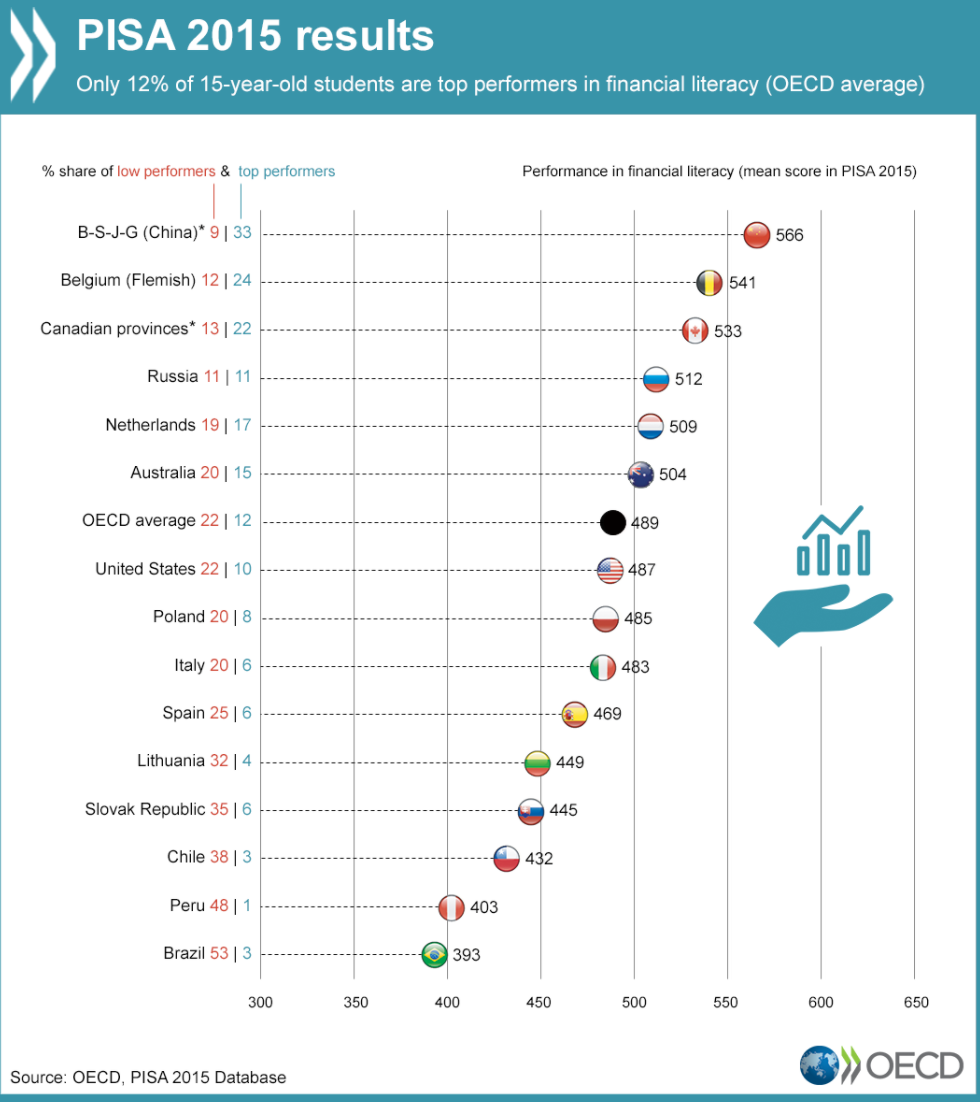

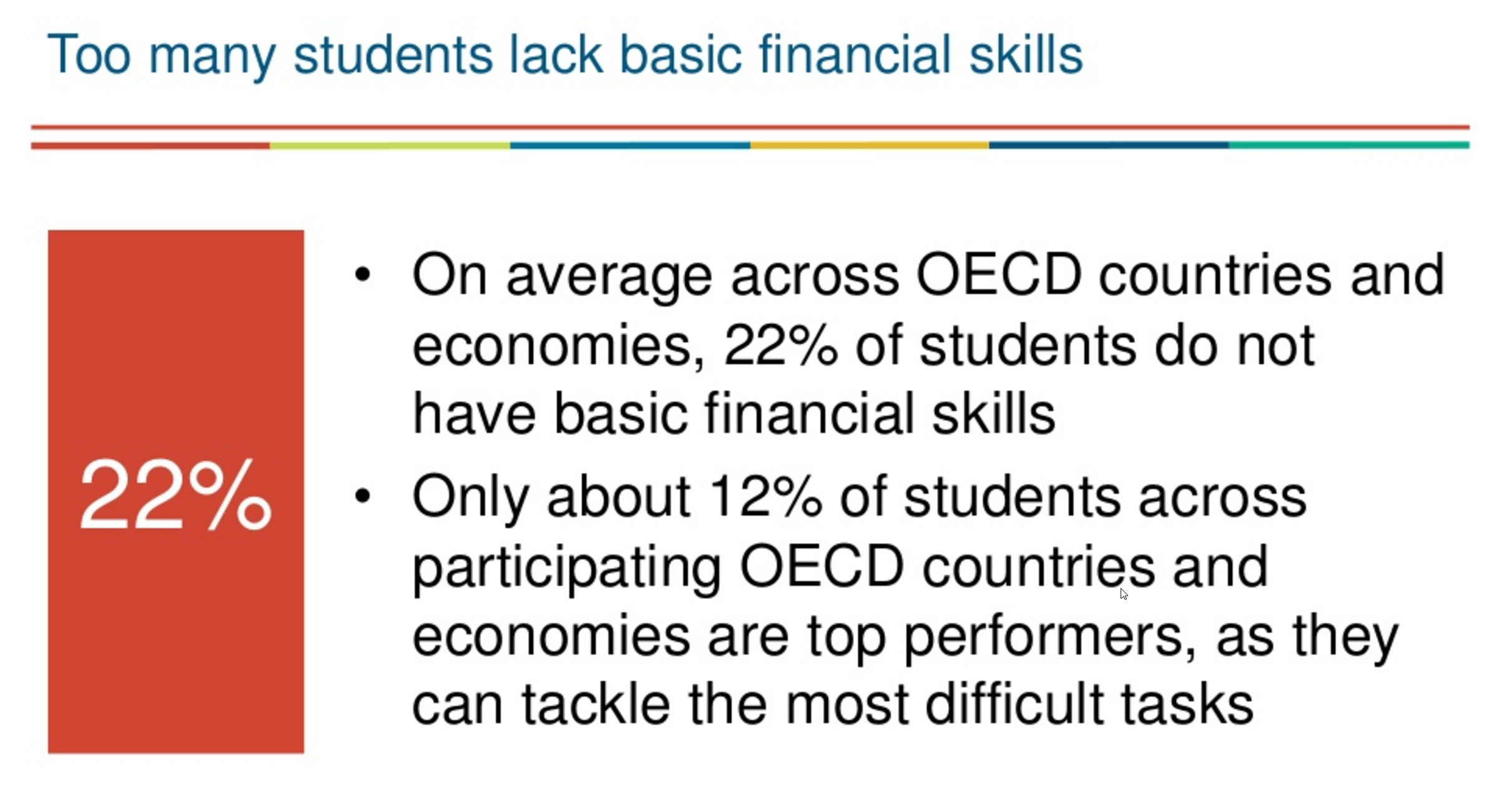

Many teenagers struggle to understand money matters. Around one in four students in the 15 countries and economies* that took part in the latest OECD Programme for International Student Assessment (PISA) test of financial literacy are unable to make even simple decisions on everyday spending, while only one in ten can understand complex issues, such as income tax.

Beijing-Shanghai-Jiangsu-Guangdong (China) had the highest average score, followed by the Flemish Community of Belgium, the participating Canadian provinces (British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island), the Russian Federation, the Netherlands and Australia. US teenagers score below the OECD average. Among the countries with data for 2012 and 2015, only students in Italy and Russia made any headway in their performance in financial literacy. This is worrying because it’s an uphill struggle.

Students who do well in financial literacy are also likely to perform well in the PISA reading and mathematics assessment, and students who have weak financial literacy skills are likely to do poorly in the other core PISA subjects. But on average across the 10 participating OECD countries and economies, around 38% of the financial literacy score reflects factors unique to financial skills.

Socioeconomically‑advantaged students scored much higher than less-advantaged ones. Native-born students also performed better than immigrant students with similar socioeconomic status, particularly in the Flemish Community of Belgium, Italy, the Netherlands and Spain. The flip side of the strong link between socioeconomic status and performance is that parental support is not enough and there is a role for educational institutions to play in ensuring a level playing field.

On average, 64% of students across OECD countries and economies participating in the study earn money from some formal or informal activity, such as working outside school hours or doing occasional informal jobs. About 59% of students receive money from an allowance or pocket money.

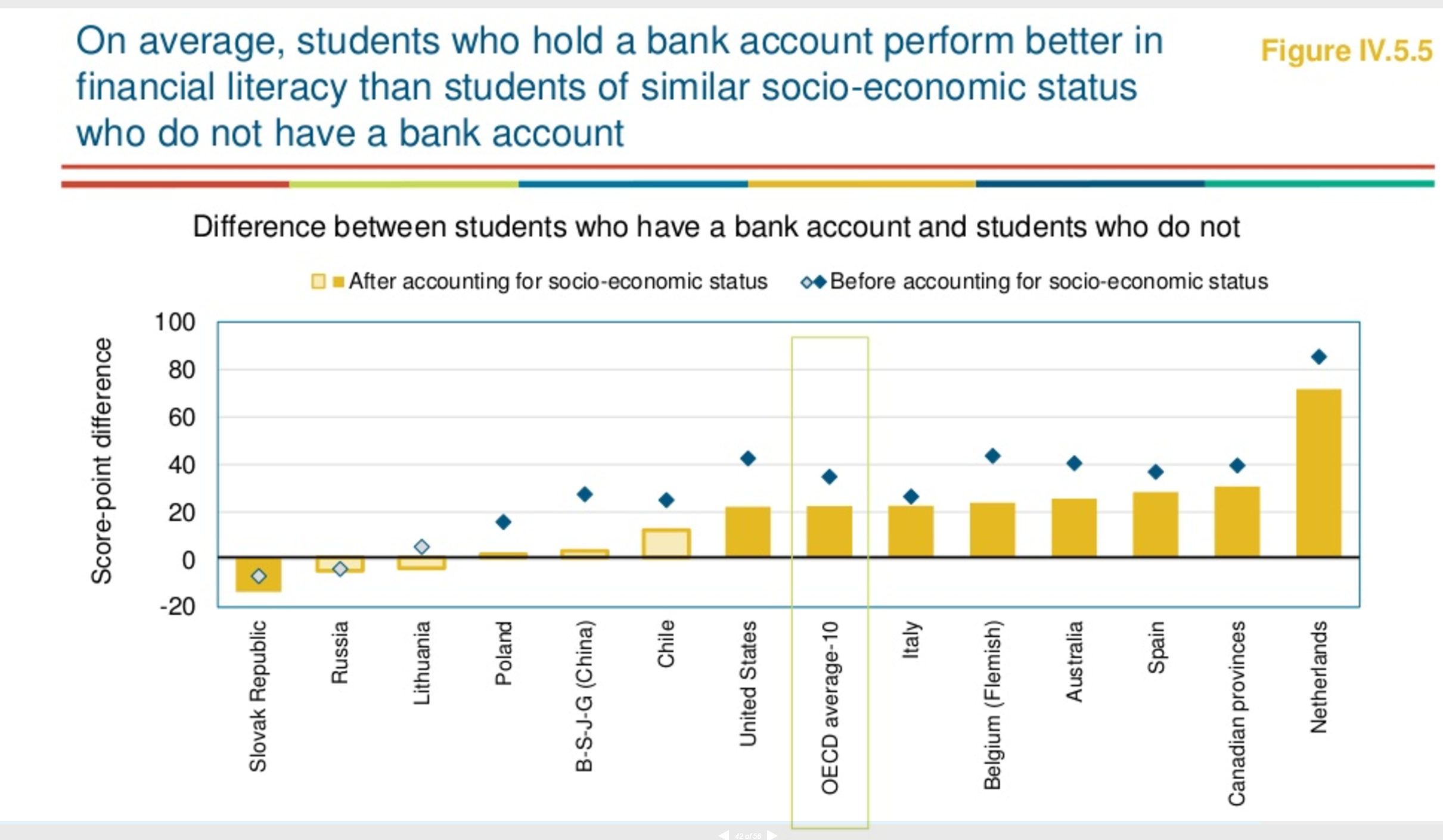

The survey also revealed that, on average, 56% of students hold a bank account, but almost two out of three students do not have the skills to manage an account and cannot interpret a bank statement.

How did the Flemish student perform ?

The average Flemish 15 year old teenager has a relative good insight in managing a budget compared to teenagers in other rich countries. 88 % of the students does have enough financial literacy to participate in the society. Belgium scores better than the OESO average and some neighbor countries.

But nevertheless there is still 12% that is NOT ready to participate in the society. In 2012 this was only 8,2%. The difference in financial literacy between teenagers born in Belgium and immigrants is big. The difference corresponds with three years of school. A part can be explained by the social-economical status.

The Flemish government decided there will be minimum objectives for financial literacy going forward. How high these objectives will be set, is not known. Today is managing money and financial education only part of the end terms for college and there is no minimum requirement for knowledge….

Let’s hope those political discussions won’t take too long as time flies. I repeat one important conclusion

12% of the Flemish teenager is not ready for society

You can download the Dutch PISA report here : Rapport financiële geletterdheid PISA2015

What did we learn ?

When we reviewed the presentation of the official PISA report, we also learned three important facts.

Key Learning 1 : Give your child a BANK ACCOUNT

Evidence that there is a positive relationship between performance in financial literacy and holding a bank account, suggests that some kind of experience with money or financial products can provide students with an opportunity to reinforce financial literacy, or that students who are more financially literate are more motivated to use financial products, and perhaps more confident in doing so. Young people can also learn through after-school initiatives. In some countries, governments and not-for-profits are offering young people videos, competitions, interactive tools and serious games via digital and/or traditional platforms.

I had few months ago a discussion with a family member because I opened a bank account for my son. They said :” why you open a bank account for a 12 year old?” Well, here is the answer. The sooner he has one, the sooner he can learn how to manage his bank account and money…

Key Learning 2 : Talk, discuss and educate about MONEY MATTERS

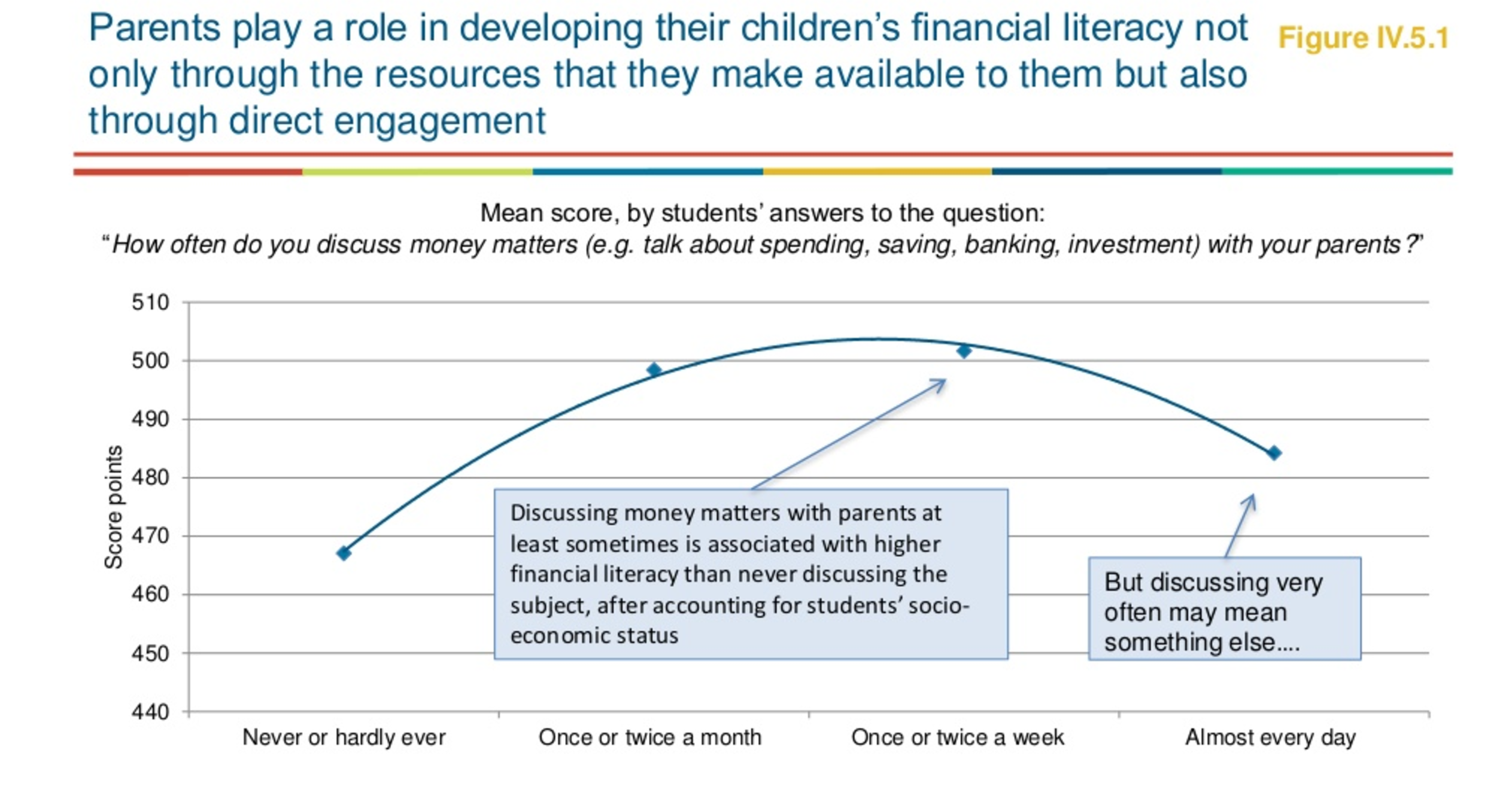

Parents and families play an important role. PISA results show that when students discuss money matters with their parents, they have significantly higher financial literacy skills, even after accounting for differences in socio-economic background. Young people can also learn on their own by using appropriately regulated financial products in a context where young consumers are adequately protected.

The below result show the importance about discussing money matters with your teenager and how important your parental role in educating financial literacy.

Key Learning 3 : Understand the importance of SAVING

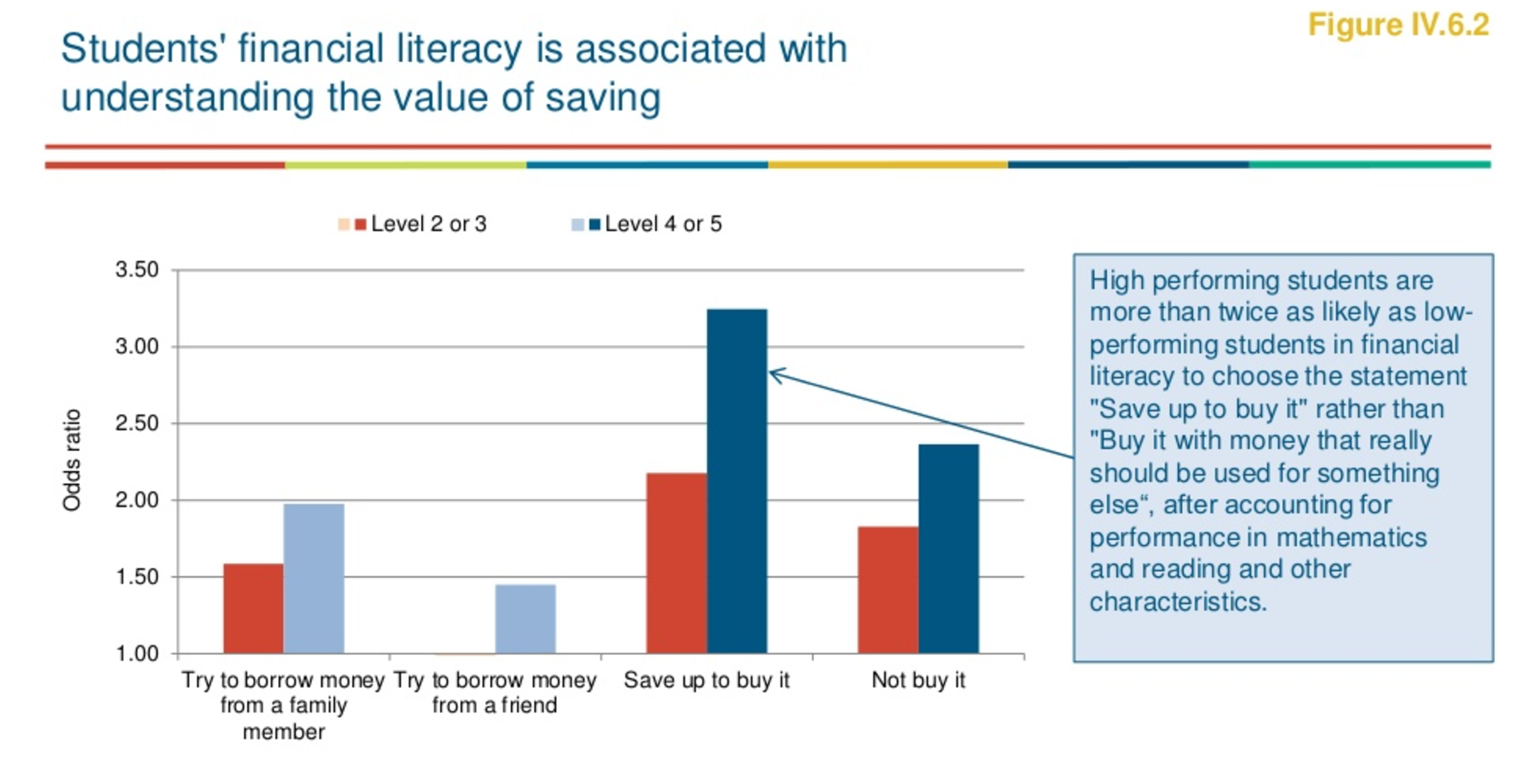

Two in three 15-year-old students earn money from work activity. 79% of Australian students took out a public loan in 2013; in the Netherlands, students graduate with an average debt of USD18 000. The decisions you make at young age impact your financial future. How is the financial literacy related to students’ financial behaviors and future expectations?

High performing students are more likely to save up before buying it. Top performing students in financial literacy are also more likely to complete university education.

Going forward

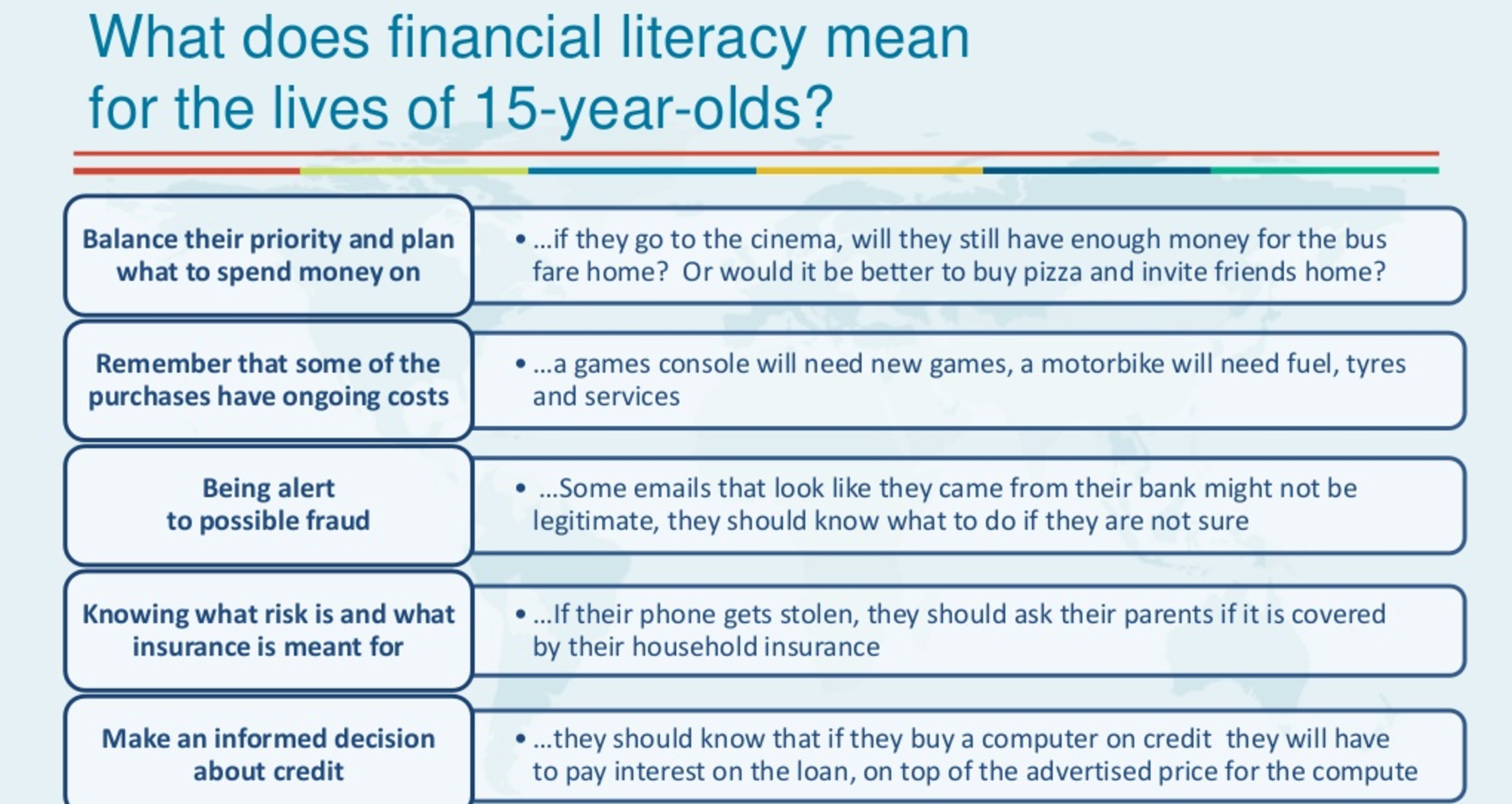

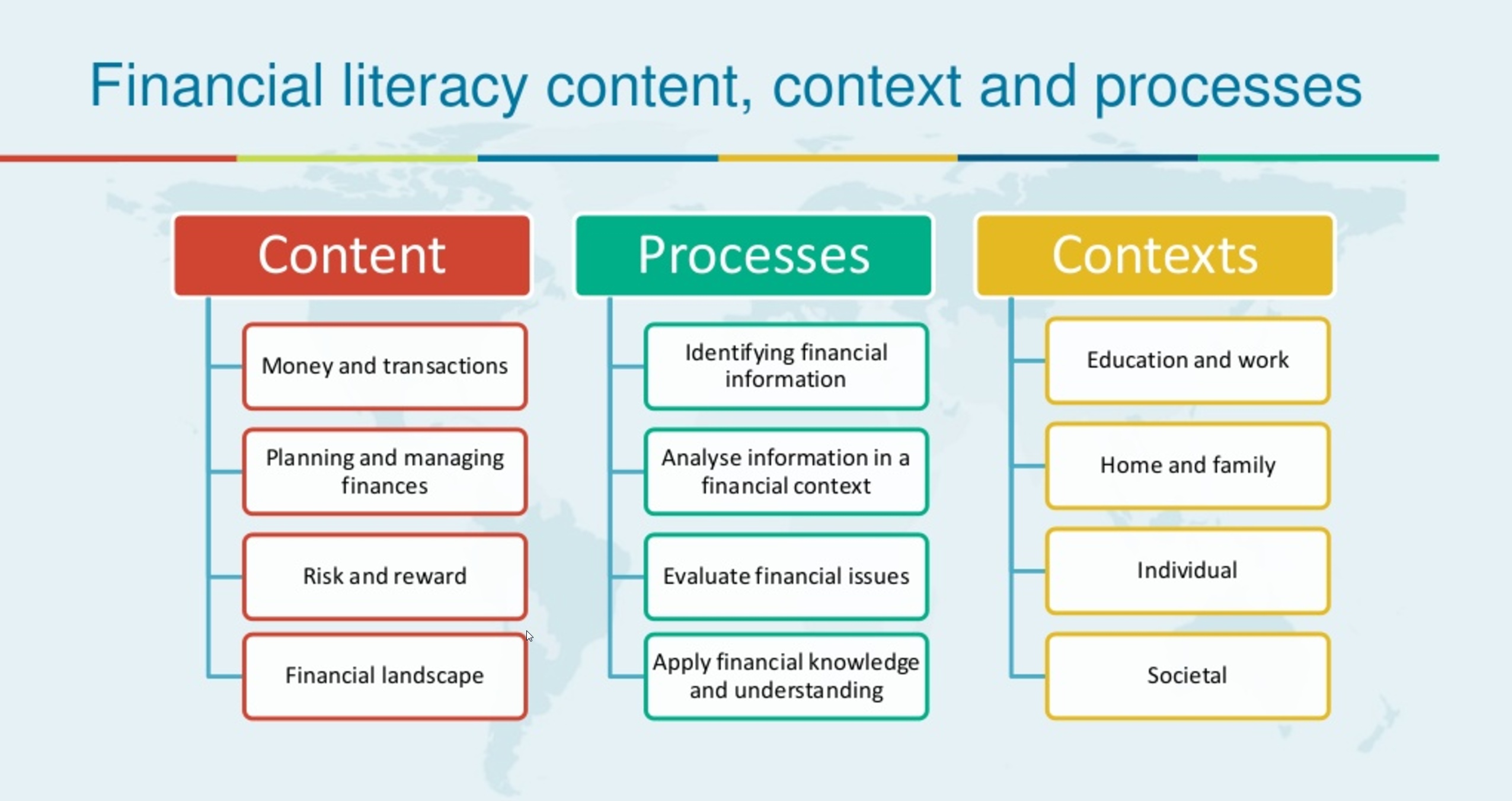

As I don’t need to be convinced about the importance of educating financial literacy, we definitely learned a couple of things from this survey. Going forward we will use the PISA financial literacy framework for structuring our financial education lessons for our kids. I did find the below overview very useful to structure the content that I create for the kids and for you.

As I develop the content, I wil structure each lesson according to each below foundation : Content, Processes, Contexts. As I now have the questions of the PISA test, I can prepare my kids sooner than later. The blog post Kids Financial Education Lesson 1 : Budg€t Fun can be categorized under Content – Planning and managing finances.

Schools play an important role in giving all children a fair chance to succeed. Some school systems already do this very well. Students in the four Chinese provinces and municipalities that took part in the test – Beijing, Jiangsu, Guandong and  Shanghai – came out well ahead of their peers in every other country. Even more impressive, the socially and economically most disadvantaged quarter of students in these provinces did as well as the second wealthiest quarter of students in the United States, and better than the wealthiest quarter of students in Brazil, Chile and Peru. We strongly recommend that Minister Hilde Crevits travels to China and learns how they do it. Learn from the best is the best way to improve our school system. As I travel to China soon, I will ask my Chinese colleagues about this topic.

Shanghai – came out well ahead of their peers in every other country. Even more impressive, the socially and economically most disadvantaged quarter of students in these provinces did as well as the second wealthiest quarter of students in the United States, and better than the wealthiest quarter of students in Brazil, Chile and Peru. We strongly recommend that Minister Hilde Crevits travels to China and learns how they do it. Learn from the best is the best way to improve our school system. As I travel to China soon, I will ask my Chinese colleagues about this topic.

I definitely recommend that educators should look for complementarities such as my blog and other blogs, projects of FMSA (week van het geld) , and other initiatives where financial education becomes a context that helps make learning in traditional school disciplines more relevant and interesting.

Are you smarter than the average 15 year old ?

Do the test! Answer the sample questions that the students had to solve during the PISA 2015-test. Click on the below link

Did you perform the test? Did you ask your teenager to perform the test ? Did you learn something from this blog post ? Let us know your comments and feedback. Thanks in advance.

As usual, I end with a quote. Do you know Judith Jamison. Judith Ann Jamison is an American dancer and choreographer, best known as the Artistic Director of Alvin Ailey American Dance Theater.

Have a great day ! Thanks for reading and following us.

2 Response Comments

Very interesting, seems like us Australian’s are doing alright for financial literacy, which I do find interesting.

Yes, better than the OECD average and better than the Americans. I hope your government wants to improve that score 🙂

Thanks for stopping by